Layer 1 blockchain networks comparable to Bitcoin and Ethereum type the basis of the cryptocurrency ecosystem and allow clever contract capabilities that allow new industries comparable to decentralized finance (DeFi) and 0 tokens. Replacement (NFT).

Avalanche (AVAX) is a comparatively new Layer 1 resolution, the price and acceptance of which have elevated considerably just lately as Ethereum’s good contract platform continues to battle with transaction prices, excessive translation charge and slower processing time in comparison with opponents .

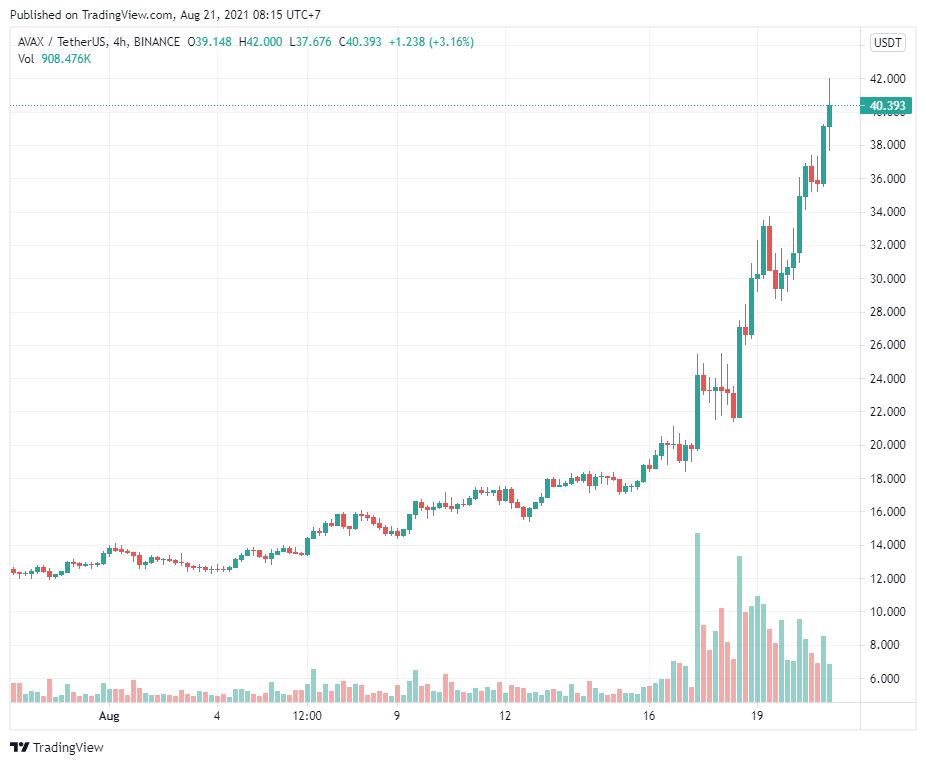

Data from TradingView reveals that after hitting $ 12.24 on August 3, AVAX price climbed to a multi-week excessive of $ 42 this morning (August 21) as trading quantity elevated 205%.

The three reasons for AVAX’s important price development are the quickly rising DeFi ecosystem, the launch of the Avalanche Bridge to Ethereum, and the distinctive token economic system design of the charging protocol, which works to detect modifications in the community’s transaction and can enhance or lower the transaction charges and the token burning mechanism accordingly.

Avalanche Rush expands DeFi ecosystem

One of the largest developments associated to the Avalanche Protocol is the Avalanche Rush announcement on Jan. imagine extra purposes and property for its rising DeFi ecosystem.

“Experience the power of the avalanche. Welcome to Avalanche Rush, a $ 180 million liquidity mining incentive program in partnership with leading DeFi dApps – both inside and outside of Avalanche – starting with Aave and Curve. And that’s only phase 1! ”.

Phase 1 of the Rush program is slated to start in the close to future and can enable AVAX for use as an incentive for liquidity mining for Aave and Curve customers over a three-month interval.

A complete of $ 27 million in AVAX funding was supplied by the Avalanche Foundation to fund the incentive program, with extra allocations deliberate for Phase 2.

The program is designed to display the Avalanche Foundation’s dedication to scaling DeFi throughout the community and to assist “create a more accessible, decentralized, and cost-effective ecosystem”.

Evidence of DeFi development in the Avalance community is the rising Total Value Locked (TVL) in protocols on the community comparable to Pangolin and Benqi Finance, which just lately exceeded $ 300 million on TVL.

Ethereum bridge that facilitates the motion of property

The second cause the Avalance ecosystem has grown over the previous few weeks is that release Avalanche Bridge (AB) on July twenty ninth. This “next generation cross-chain bridge technology” allows the switch of property between the Avalanche community and the Ethereum community.

(*3*).

In the three weeks since AB’s inception, greater than $ 100 million value of tokens have been moved between the two networks as holders search a decrease charge atmosphere to conduct their transactions.

AB is estimated to be 5 occasions cheaper than the earlier Avalanche-Ethereum Bridge (AEB) and is anticipated to “provide a better user experience than any cross-chain bridge introduced to date”.

If Ethereum cannot deal with the excessive transaction prices anytime quickly, it is extra seemingly that property and liquidity will proceed emigrate to blockchains like Avalanche as their DeFi ecosystem grows in measurement and worth.

Unique Tokenomic with Token Burning Muscle

The third cause for the rising curiosity in the Avalanche Network is the distinctive tokenomic construction of the protocol, which incorporates: Charge Burning Mechanism Transactions assist cut back the circulating provide over time.

“Avalanche burns all transaction fees.”

As talked about in the tweet above, all Avalanche charges can be burned for the profit of everybody in the neighborhood as the restricted AVAX provide of 720 million is assured to lower over time. This may help enhance the worth of the remaining tokens in circulation.

At the time of writing, over 163,000 AVAXs have been burned and can develop sooner as extra customers transact on the community.

The community’s charging mechanism can also be set as much as replace to Apricot Phase 3 imagine C-Chain dynamic charge on August twenty fourth.

Apricot Level 3: Dynamic C-Chain Fees. Apricot Phase Three Upgrade can be activated on Tuesday, August twenty fourth (UTC) at 6:00 p.m. on the Avalanche Mainnet.

The integration permits the addition of time-based pricing, a restricted charge vary of 75-225 nAVAX and a block restrict of 8 million gasoline.

You can view particulars about AVAX pricing.