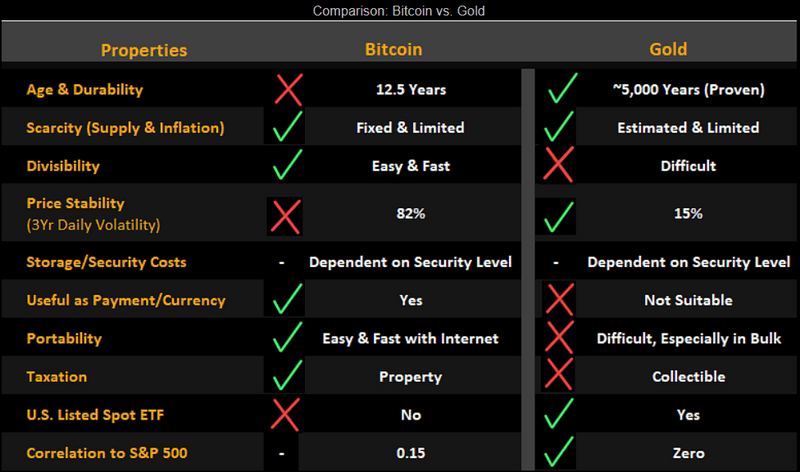

The debate between gold bugs and Bitcoin believers over which is the better store of value will likely persist as prices for both rise. The gold camp cites the metal’s long history vs. Bitcoin’s instability and lack of regulatory support. Grayscale and Bitcoin backers see the cryptocurrency as “digital gold,” with superior efficiency and potential.

Complementary assets in a portfolio

Rather than positioning Bitcoin and gold as polar alternative assets, we think they can complement each other in a portfolio. Gold has better applications in some cases, and Bitcoin in others. Bitcoin is more transportable and divisible, and more applicable as a currency. But gold is more stable, with a proven track record. Both offer virtually no correlation to traditional asset classes, with gold’s correlation at 0. Still, Bitcoin is currently most aptly characterized as a speculative asset.

For these reasons and due to the potential for Bitcoin to eventually become a store of value, many institutions and investors are converting at least small portions of their gold positions to Bitcoin as a hedge and diversifier. Source: Bloomberg Intelligence

Source: Bloomberg Intelligence

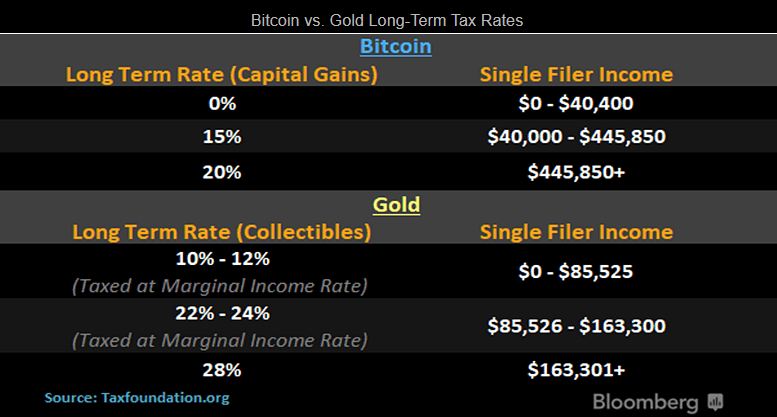

U.S. tax rates more favorable for Bitcoin

Gold and Bitcoin have different long-term U.S. tax rates (on investments bought and sold over more than one year). For short-term capital gains (on investments bought and sold within a year), both are taxed at the individual’s income-tax rate. Bitcoin is taxed in the same way as stock ownership, with a long-term capital-gains rate of 0-20%, depending on income level. Gold is taxed as a collectible and therefore carries a long-term rate of 28%, irrespective of an investor’s income. Source: Bloomberg Intelligence

Source: Bloomberg Intelligence

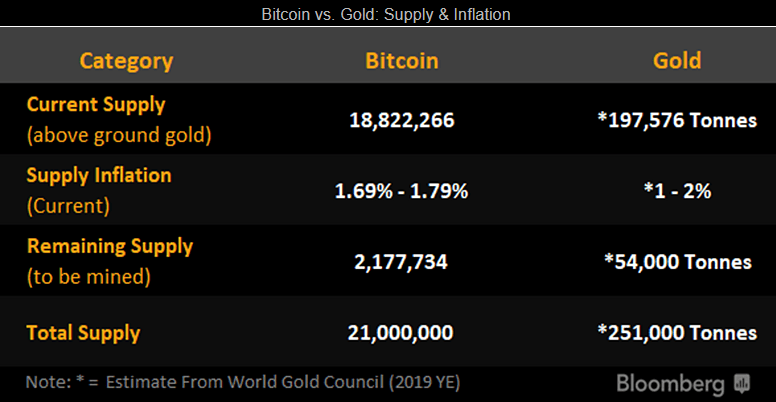

Limited supply and fixed inflation

Bitcoin is already a store of value within the world of cryptocurrencies and could be embraced on a wider scale. Gold has been accepted as a store of value globally for centuries, but the amount available on Earth is finite and the mining rate has been relatively stable, with World Gold Council estimates of above-ground supply increasing about 1-2% a year. Bitcoin’s limited supply and controlled inflation are its monetary backbone. The last Bitcoin is expected to be mined in 2140 (coded to a maximum of 21 million coins), according to a fixed, disinflationary schedule.

Gold supply theoretically could jump from the discovery of a massive deposit or the advent of space mining, though either is unlikely. Potential concerns for Bitcoin include a blockchain hack via quantum computing and government bans. Source: Bloomberg Intelligence

Source: Bloomberg Intelligence

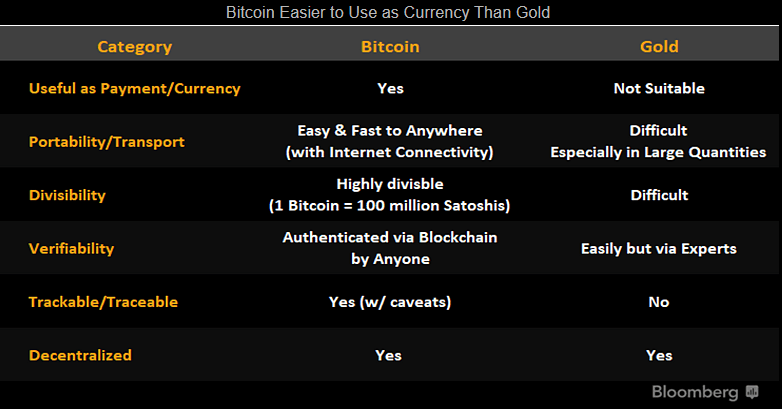

Medium-of-exchange edge goes to Bitcoin

Bitcoin is superior to gold as a medium of exchange or form of payment. Unlike gold, Bitcoin is a fixed unit of account and easily divisible and transportable. Gold isn’t easily divisible on the spot, and there are potential issues with purity and verification. The ability to trace Bitcoin on blockchain ledger technology will likely prove to be a substantial advantage, especially in cross-border transactions.

Digital currencies are starting to be accepted as a form of payment with vendors and retailers. Many working in the crypto community are paid in cryptocurrencies such as Bitcoin. In addition, a growing number of professional athletes and others have signed up for services that automatically convert income into cryptocurrencies upon fiat payment. Source: Bloomberg Intelligence

Source: Bloomberg Intelligence

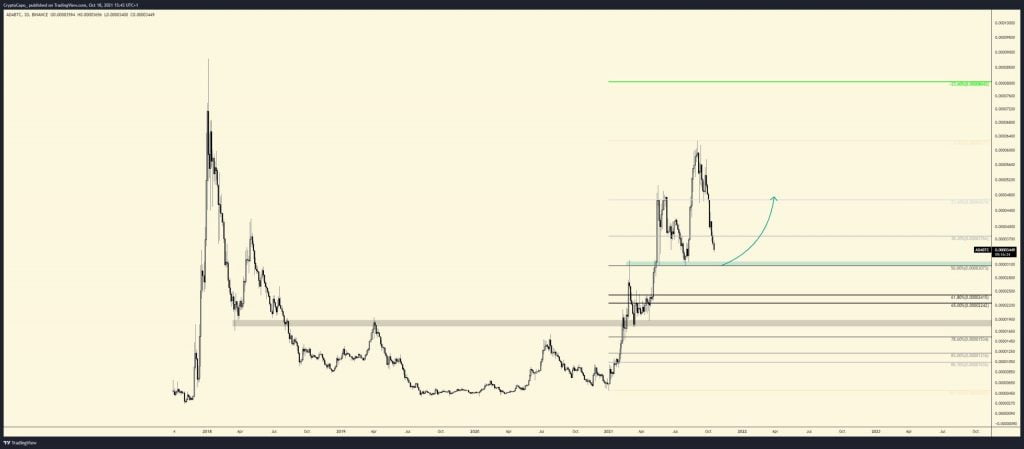

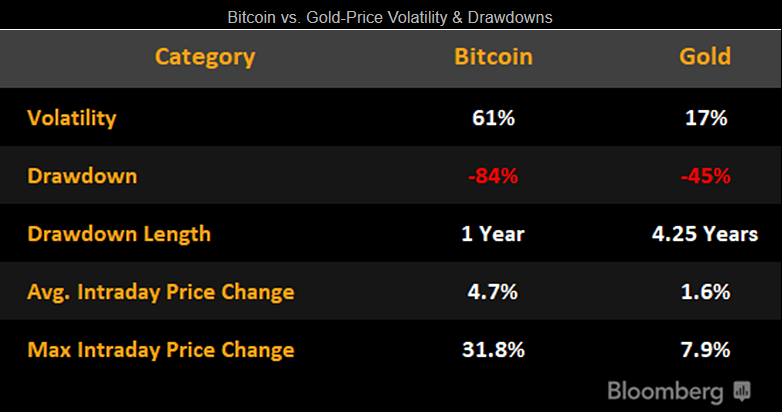

Superior stability, smaller declines for gold

Bitcoin’s price volatility and history of drawdowns limit its use as a store of value, and even as a form of payment. Gold supporters contend that an asset can’t be a store of value when it’s capable of declining 80% in 12 months, as Bitcoin has. Yet gold isn’t entirely immune — from September 2011 to December 2015, for example, the metal fell about 45% in U.S. dollar terms.

Bitcoin’s volatility is another concern. Since launching, prices have been 4-5x as volatile as gold’s, making it difficult for merchants to accept the cryptocurrency as payment. Bitcoin’s average intraday price change in the past three years has exceeded 5%. That’s down from 6.4% a few years ago, while gold’s volatility has been relatively stable. Source: Bloomberg Intelligence

Source: Bloomberg Intelligence