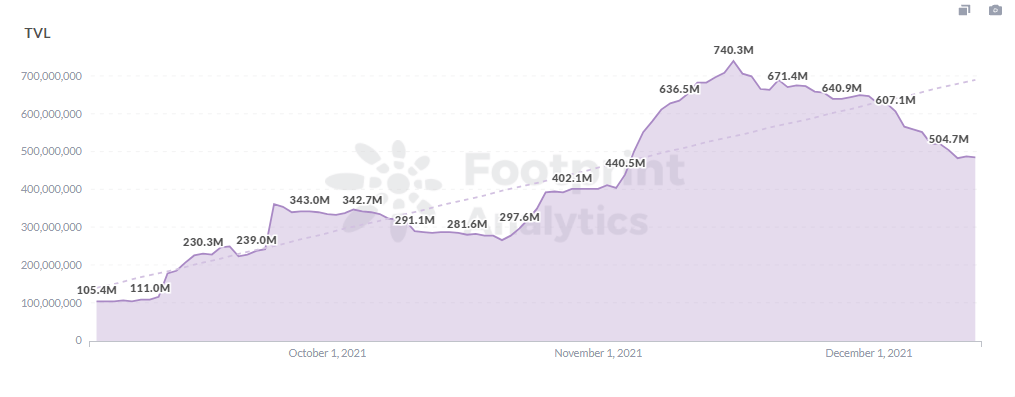

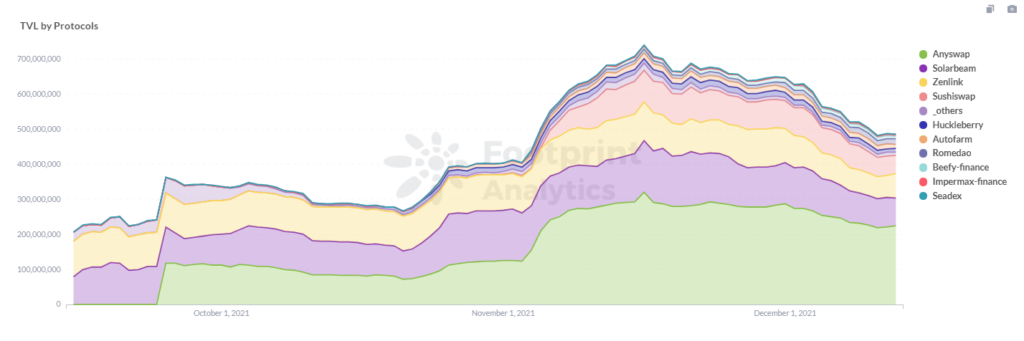

And as Polkadot grows, so too does its ecosystem. Moonriver, the second parachain to get a slot in Kusama, has expanded its TVL to an all-time high of $700 million in mid-October before dropping back to $500 million as of Dec. 12. It is ranked 22nd for TVL.

Moonriver as Moonbeam’s Canary Network

Moonriver is the canary network of Moonbeam developed by the PureStake team. Moonbeam hopes to build an EVM-compatible smart contract platform that will allow developers to better deploy smart contracts and DApp front-end offices on Ethereum to the Polkadot ecosystem at minimal cost while also connecting to other chains on Polkadot.

Moonriver is connected to Kusama’s relay chain, and Moonbeam is connected to Polkadot’s chain. The relationship between Moonriver and Moonbeam is similar to that between Acala and Karura. In the Polkadot ecosystem, Kusama is a canary network for Polkadot, designed to test the network as close as possible to the real environment of Polkadot to ensure the security of the network.

Projects that want to go live on Moonbeam need to be tested and verified in its permanent test environment Moonriver before their developers can deploy them on Moonbeam, ensuring the code is tested to identify potential problems. So Moonbeam will have a more stable governance system than Moonriver. But Moonriver, like Kusama in the spirit of experimentation, is a community-driven network.

Advantages of Moonriver

Moonriver has the following features for developers and users to facilitate ecosystem development.

- EVM-compatible, which utilizes the user-experience of developers and users on Ethereum, allows developers to deploy projects from Ethereum to Moonriver without rewriting contracts or reconfiguring.

- Web3-compatible allows mainstream tools on Ethereum (such as MetaMask, etc.) to link to Web3 RPC endpoints that can be used on Moonriver.

- Unified address. Existing Ethernet H160 accounts and ECDSA signatures can interact directly with Moonbeam, making it easy for users to swap costs.

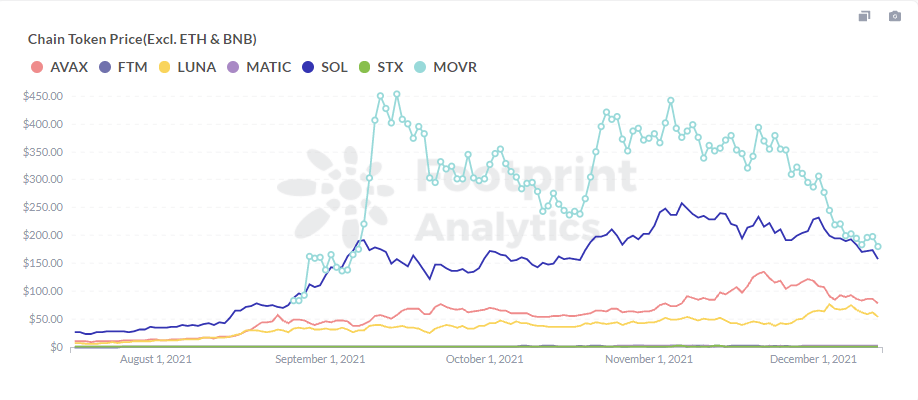

Native Token of Moonriver

MOVR is the token of Moonriver, with a price of $180 as of Dec. 12. Although the TVL of Moonriver is not ranked high among blockchains, its token price has been ranked third among mainstream blockchains, behind ETH and BNB, and even surpassed the recent popularity of Solana and Avalanche.

Moonriver is more community-focused, and MOVR plays the governance functions with the following main features:

- Gas fee metering: Users need to pay with MOVR when executing smart contracts

- Protocol security: Incentivizes organizers and provides the impetus for the creation of a decentralized node infrastructure mechanism on which the platform can operate

- On-chain governance: MOVR holders can nominate members for proposal, the election of committee members, voting, etc., thus realizing on-chain governance functions

- Network transactions: Use MOVR to pay for transactions on the network. Users can also use MOVR to trade with other tokens and even provide liquidity in DEXs to earn fees.

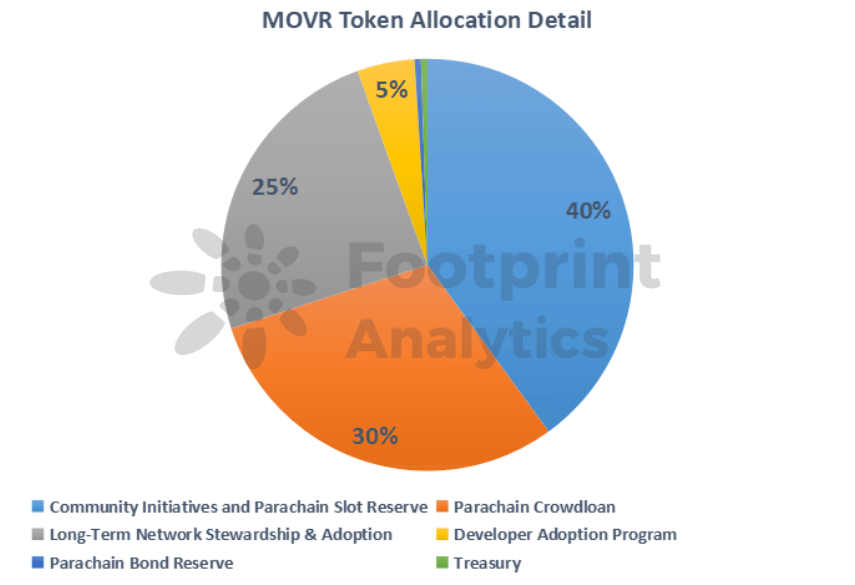

MOVR’s allocation method is more aggressive, as neither Moonriver’s investors nor the team will receive a token allocation, and the majority will be allocated to the community. Moonriver is bidding for the slot by offering 30% of MOVR’s initial supply as a Kusama crowdloan to reward allocation contributors, with the majority of the token transferred to the community within a year of launch.

Moonriver believes that the initial allocation scheme will profoundly impact the subsequent development of the entire network and will therefore undertake a more equitable and broader initial allocation scheme.

The total amount of MOVR is 10 million. Besides the 30% mentioned above—earmarked for crowdloan contributors—the rest will be distributed as follows:

- 40% to reserve for future auctions on Kusama parallel chain slots and community activities (e.g., liquidity rewards, strategic partnership rewards, etc.)

- 24.5% for long-term network maintenance, development, and other opportunities

- 4.5% earmarked for a developer support program to help projects deploy quickly

- The remaining 1% is used for reserves for parachain bond, payment of slot auction fees, and treasury.

Moonriver allocates more tokens to the community than Moonbeam’s token GLMR allocation scheme (26% for funding, and about 20% for key members, early and future employee incentives). This strategy makes Moonriver look very different compared to other programs.

DeFi Ecosystem of Moonriver

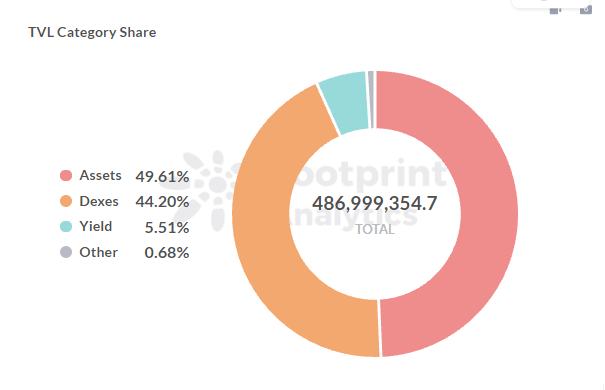

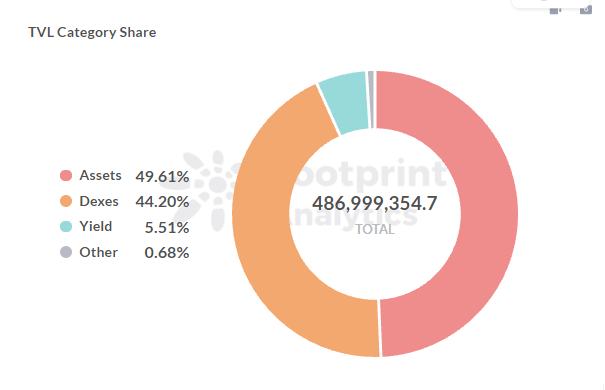

Data shows that Moonriver is still dominated by DEXs and assets projects, with yield only accounting for 5% of the DeFi ecosystem. This is in contract to other head blockchains where DEX and lending are the cornerstones. This distribution is still relatively undiversified, and Moonriver still needs to attract more developers to enrich its ecosystem.

Regarding protocols, the top TVL as of December 12 is AnySwap ($225 million), followed by Moonriver’s native DEX project Solarbeam ($80 million). And SushiSwap in third and fourth place with about $70 million and $52 million.

Summary

Moonriver has only been launched for four months but has already become a notable project among blockchains—the price of MOVR is more than many popular blockchains. At present, DEXs dominate Moonriver’s DeFi ecosystem. Given its EVM compatibility, there may be a more robust round of TVL growth when more lending projects are introduced.

The Moonriver team also said that more cross-chain bridges and oracles would be deployed to the chain, and they keep disclosing cooperation with many significant projects in ecosystem construction.