Bitcoin traded in a tight range this week, which provided some relief to market participants after a volatile start to the year. The cryptocurrency was roughly flat over the past 24 hours and up about 3% over the past week, compared to a 5% gain in ether.

Some traders and analysts remain cautious despite the brief price bounce off $40,000 earlier this week.

“Price swings are all happening on wafer-thin volumes, which can amplify price movements,” Q9 Capital, a Hong Kong-based crypto investing platform, wrote in a briefing on Friday. “No fresh capital is coming in and nobody is willing to sell or buy,” Q9 wrote.

“Attempts earlier in the week to form a rebound are encountering more substantial selling, further indicating seller pressure,” Alex Kuptsikevich, an analyst at FxPro, wrote in an email to CoinDesk.

Kuptsikevich is especially concerned about further declines in ether, the world’s second-largest cryptocurrency by market capitalization after bitcoin. If momentum continues to deteriorate, he anticipates a worst-case scenario of $1,300-$1,700 ETH, which is roughly 50% below current price levels.

Latest prices

●Bitcoin (BTC): $43212, +1.15%

●Ether (ETH): $3308, +1.22%

●S&P 500 daily close: $4663, +0.08%

●Gold: $1816 per troy ounce, −0.29%

●Ten-year Treasury yield daily close: 1.77%

Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price.

But not all corners of the crypto ecosystem are experiencing a slowdown in trading activity.

Non-fungible token (NFT) trading volumes continue to soar. For example, OpenSea, a large NFT marketplace, is on pace to exceed $6 billion in transactions by the end of the month.

And dogecoin (DOGE), the popular dog-themed meme coin, surged almost 14% on Friday after electric-car maker Tesla went live with accepting the cryptocurrency as payment for merchandise. DOGE is up about 20% over the past week.

In observance of the Martin Luther King Jr. Day holiday in the U.S. on Monday, Market Wrap will return on Tuesday, Jan. 18.

Long-term bitcoin holders unfazed

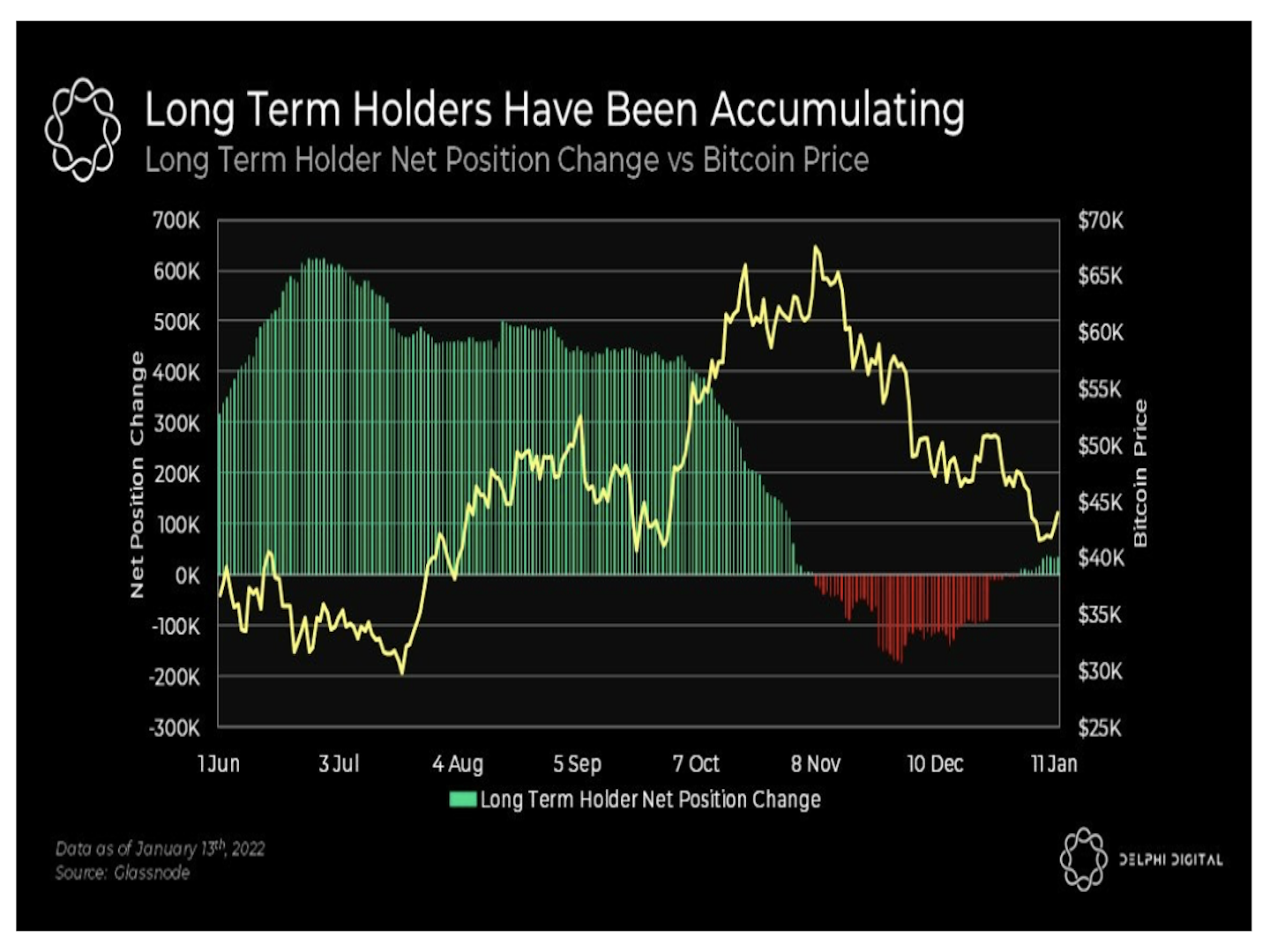

Some investors are still holding bitcoin for the long term despite the recent sell-off. The chart below shows an increase in the net position change among long-term bitcoin holders this month. Accumulation of BTC around current price levels could be a bullish sign.

The increase in long-term holder positions “gives a positive outlook for bitcoin’s price,” Marcus Sotiriou, an analyst at the U.K.-based digital asset broker GlobalBlock, wrote in an email to CoinDesk. Sotiriou expects BTC to rebound to the $45,000-$46,000 price range in the coming days.

Altcoin roundup

- Short traders on Dogecoin lost $8M: Dogecoin (DOGE) traders lost more than $11.69 million in total to liquidations in Asian morning hours as the meme coin surged 16% in the past 24 hours. The total includes leveraged traders betting on an upside losing another $4 million on margin calls. The figures were much higher than liquidations on bitcoin or ether futures, which usually see the most losses among all cryptocurrencies. The price rally came as electric-car maker Tesla went live with dogecoin payments for merchandise early Friday. Tesla fans can now purchase belt buckles, whistles, chargers and a quad bike using the meme coin on the official store, as reported, according to Saurya Malwa.

- Fees.Wtf’s low liquidity in initial minutes made users lose $135K after an airdrop: Ethereum blockchain data shows a user lost over $135,000 worth of ether trying to purchase Fees.wtf tokens (WTF) soon after an airdrop on Thursday night. The slippage was caused due to low liquidity in the trading pool, causing some in crypto circles to criticize how Fees.wtf developers funded the initial pool, according to Saurya Malwa.

- Crypto options’ impact on the spot market: While a correlation between equities and crypto has become more apparent during the last year, Singapore’s QCP wrote traders buying large amounts of downside risk reversals (where a trader buys the put and sells the call) are now switching positions to take profit (where they sell the put and buy the call), potentially influencing the spot market, according to Sam Reynolds.