The non-fungible token (NFT) sub-sector is seeing remarkable adoption as more investors look to tap into the rapidly changing crypto economy. Per data from the industry website NonFungible.com, the NFT scene has grown more than 3,000% from Q2, 2020 with over $754 million total value locked (TVL). While standalone projects like CryptoPunks and Bored Ape Yacht Club (BAYC) have posted eye-popping figures in sales. In this article, we uncover some of the best NFT crypto to buy as we approach the tenth month of 2021.

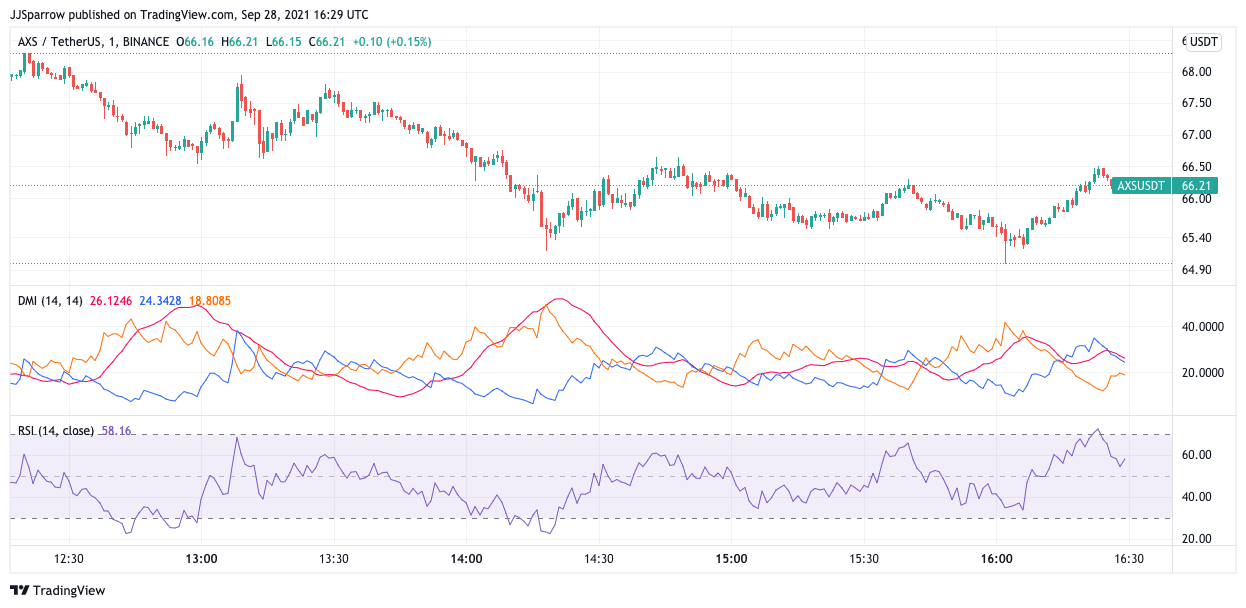

1. Axie Infinity (AXS)

Starting off our list of best NFT crypto to buy is a Pokemon-inspired gaming platform. Developed as far back as 2018 by Sky Mavis, Axie Infinity is a game that comes with a twist. Using blockchain technology, Axie Infinity enables players to become partial owners of the platform. They are able to collect, breed, raise, battle and trade tokenized characters called Axies.

Each Axie is an NFT and you need at least 3 of those to meet the protocol’s requirements. Axies have become a highly coveted crypto-asset given that each Axie is unique from the others as every one of them boasts different strengths and weaknesses. Players can choose from 500 different pairs and battle one another in a 3-man (Axie) squad with the winning team rewarded with experience points (XPs).

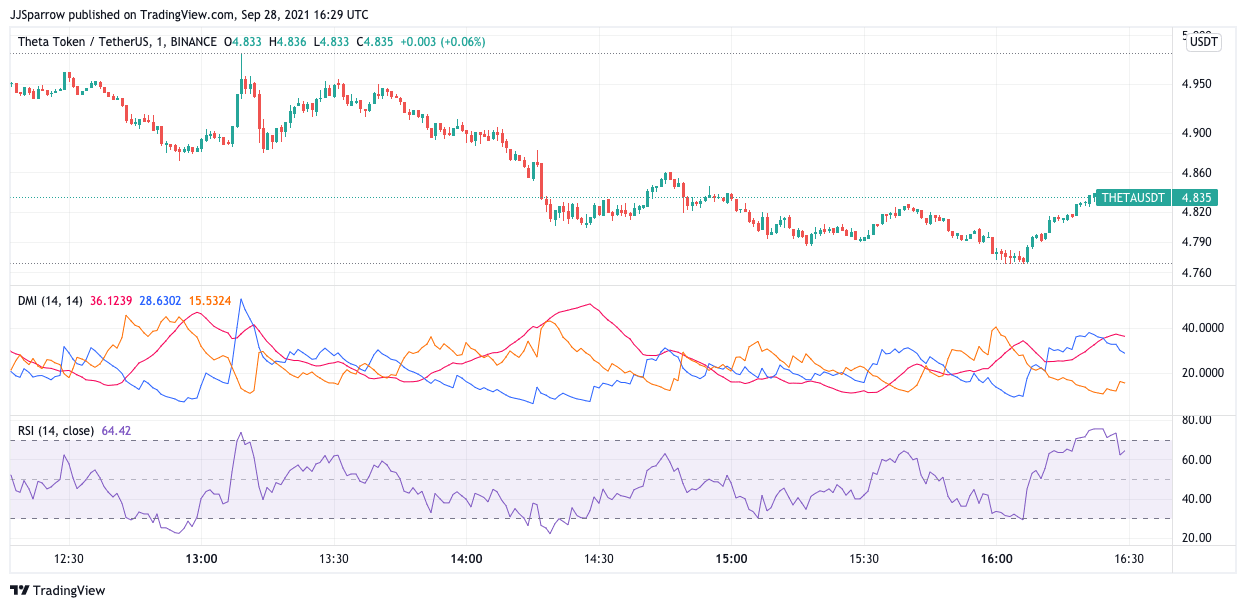

2. Theta (THETA)

Focused on the video streaming industry, the Theta blockchain is another best crypto to buy for the coming month. Theta set out to solve the challenges of video streaming alongside content distribution as the conventional channels we currently have cannot support the global need for video streaming.

It does this by incentivizing users on its network to share their bandwidth and computing resources on a peer-to-peer (P2P). Founded in 2018, the Theta blockchain has drawn a lot of applaud from streaming experts with video streaming platform YouTube co-founder Steve Chen and Twitch’s Justin Kan serving as advisers to the blockchain.

Alongside this, tech heavyweights and crypto exchanges like Google, Samsung, Binance, Gumi, and several others serve as enterprise validators for the Theta nodes. Although it is focused on video streaming, the Theta blockchain also supports NFTs through its Elite Nodes upgrade launched in the middle of the year.

This has seen Singapore-based One Championship partner with Theta to launch its first-ever NFT marketplace to celebrate its fighters. Fans with these NFTs will be able to enjoy exclusive experiences like backstage passes, ringside seats, and several others.

At the moment, THETA is trailing the crypto market in the red zone and trades at $4.83, down 5.54% on the daily chart. Despite this, is one of the top NFT cryptos on the NFT rankings.

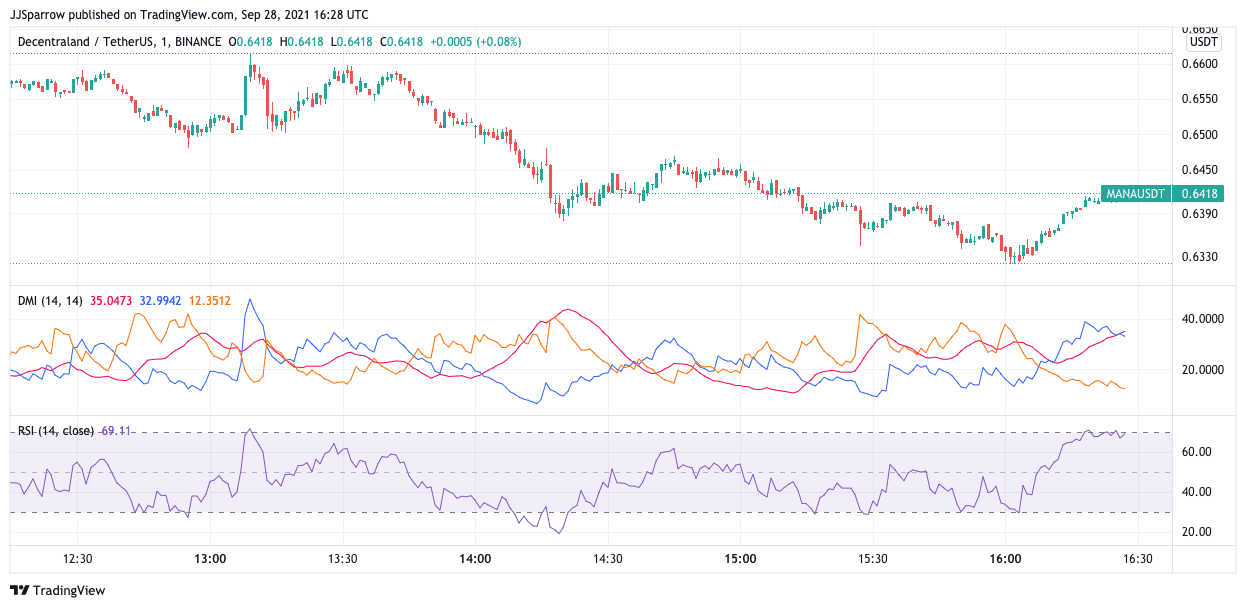

3. Decentraland (Mana)

Decentraland is one of the best NFT crypto to buy in the space. One of a slew of virtual reality platforms enabling a MetaVerse, Decentraland enables users to create, experience, and monetize content and applications.

Here, users can buy virtual plots of virtual lands where they can build on them and later sell for large sums.

Since launching in 2017, Decentraland has gone on to be a success becoming the prime destination for virtual real estate as well as the venue for interactive games and 3D scenes. This saw it snatch an NFT deal with soft drink giant Coca Cola.

Decentraland has also become a major destination for creative experiences with 23-year-old digital artist Hiroto Kai selling virtual clothes for real money on the platform.

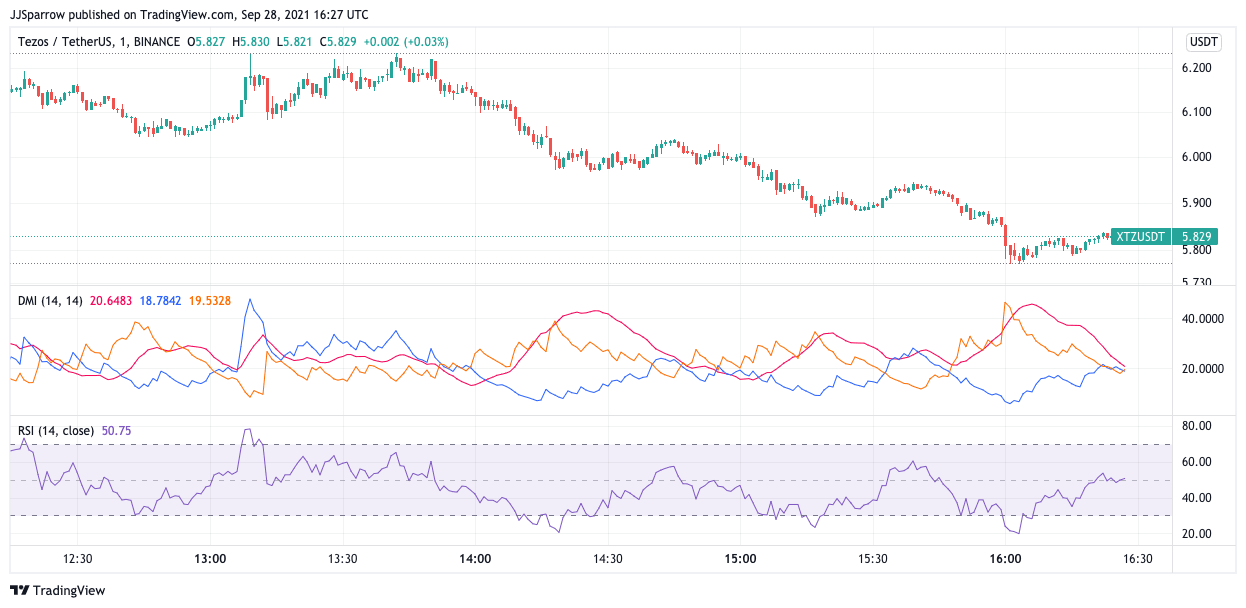

4. Tezos (XTZ)

The Tezos blockchain has been a revelation these past few weeks given a number of remarkable events.

Built by the Breitmann couple, Tezos is one of the best crypto to buy for long-term returns given its growing adoption. From the ground up, Tezos is built to be sustainable, scalable, and future-proof. It sports a delegated proof-of-stake (dPoS) consensus algorithm which makes it faster than Bitcoin and Ethereum networks. Similar to Ethereum, Tezos offers decentralized applications (dApps) support on its blockchain and engenders the massive growth of decentralized finance (DeFi) and NFTs.

Tezos hit a major media goldmine after singer and songwriter Doja Cat launched her NFT collections on Oneof – a platform building on the Tezos protocol. Her reasons stemmed from the green effect of NFT minting on the Tezos platform.

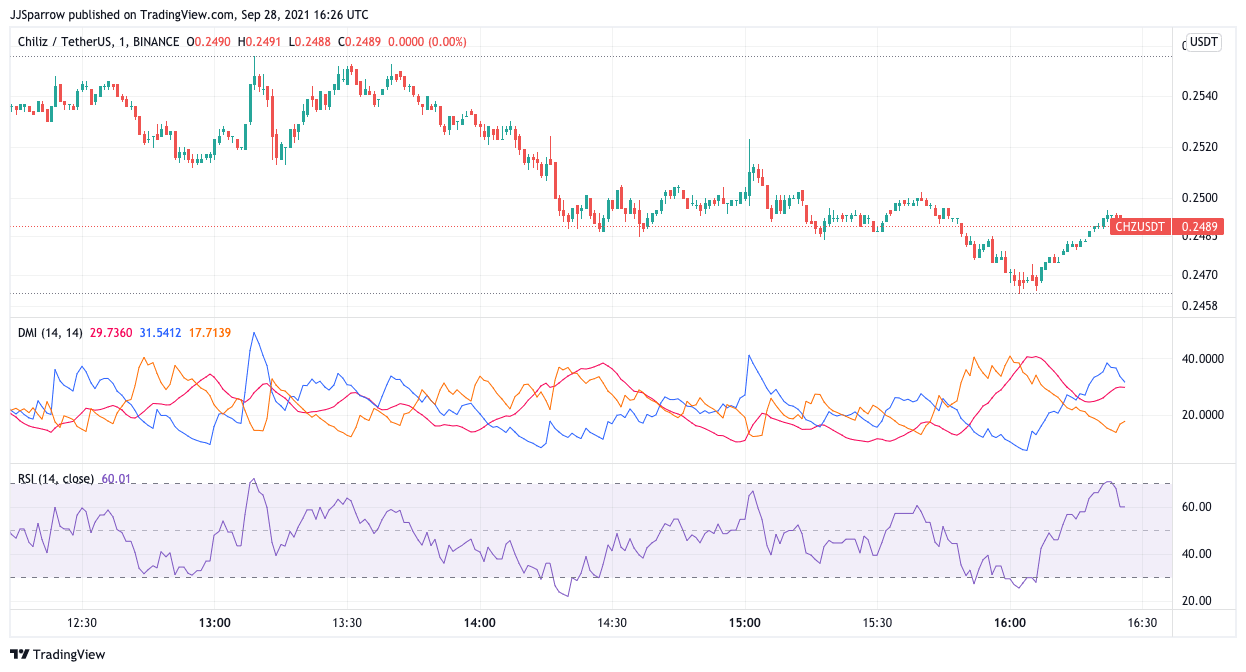

5. Chiliz (CHZ)

The Chiliz blockchain is another best crypto to buy gaining its real-world use case.

Focused on sports and entertainment industries, Chiliz enables fans to connect to their favourite club and sports through Fan Tokens. These tokens are issued through its Fan Reward and Engagement platform Socios.com. Holders of the Fan Tokens get to participate in exclusive club surveys, vote and influence decisions in the running of the club.

Also, they enjoy exclusive experiences and some fans have used their tokens to choose club slogans for the season. The Chiliz blockchain is one of the biggest NFT protocols and recently penned a partnership deal with NBA’s Charlotte Hornets.

Advertisement