In 2021, the subreddit forum r/wallstreetbets, also known as Wallstreetbets (WSB) became an extremely popular forum after the members played a major role in the Gamestop short squeeze escapade. In recent times, the founder of WSB, Jaime Rogozinski has been behind a new decentralized finance project called the Wallstreetbets Dapp (wsbdapp.com). Rogozinski spoke with Bitcoin.com News this past week and he discussed the Wallstreetbets Dapp and how traditional and crypto finance are spilling over into each other.

Wallstreetbets Collides With Decentralized Finance

Just recently, Bitcoin.com News chatted with Jaime Rogozinski, the founder of the infamous Wallstreetbets forum. These days, Rogozinski is very focused on defi and the WSB founder is now behind a new defi project called the Wallstreetbets Dapp (wsbdapp.com). Rogozinski discussed the project with Bitcoin.com News in great detail, in order to give our readers some perspective of the decentralized app, exchange-traded portfolios (ETPs), non-fungible token (NFT) assets, and his thoughts about defi regulation.

Bitcoin.com News (BCN): Can you tell our readers about the Wallsteetbets Dapp and how you got involved with the idea?

Jaime Rogozinski (JR): I was invited to join on after the idea was solidly developed by the founding team to basically create this decentralized financial (defi) ecosystem. When they invited me to come on board, I decided to put my twist on trying to combine crypto with regular equities. To bring in a lot of the people that are just exclusively trading equities and realizing the huge number of tools that are available via defi and blockchain technology.

The decentralized app (wsbdapp.com), what it does is create a trading ecosystem on a blockchain with defi. We have several components that are now available and we’re constantly looking to improve the product offerings. We have socially built exchange-traded portfolios (ETPs), as community members leverage the dapp by purchasing the tokens and they can vote on which ETPs they want to create. What kind of weighting they want to put on the ETP or how they want to rebalance it.

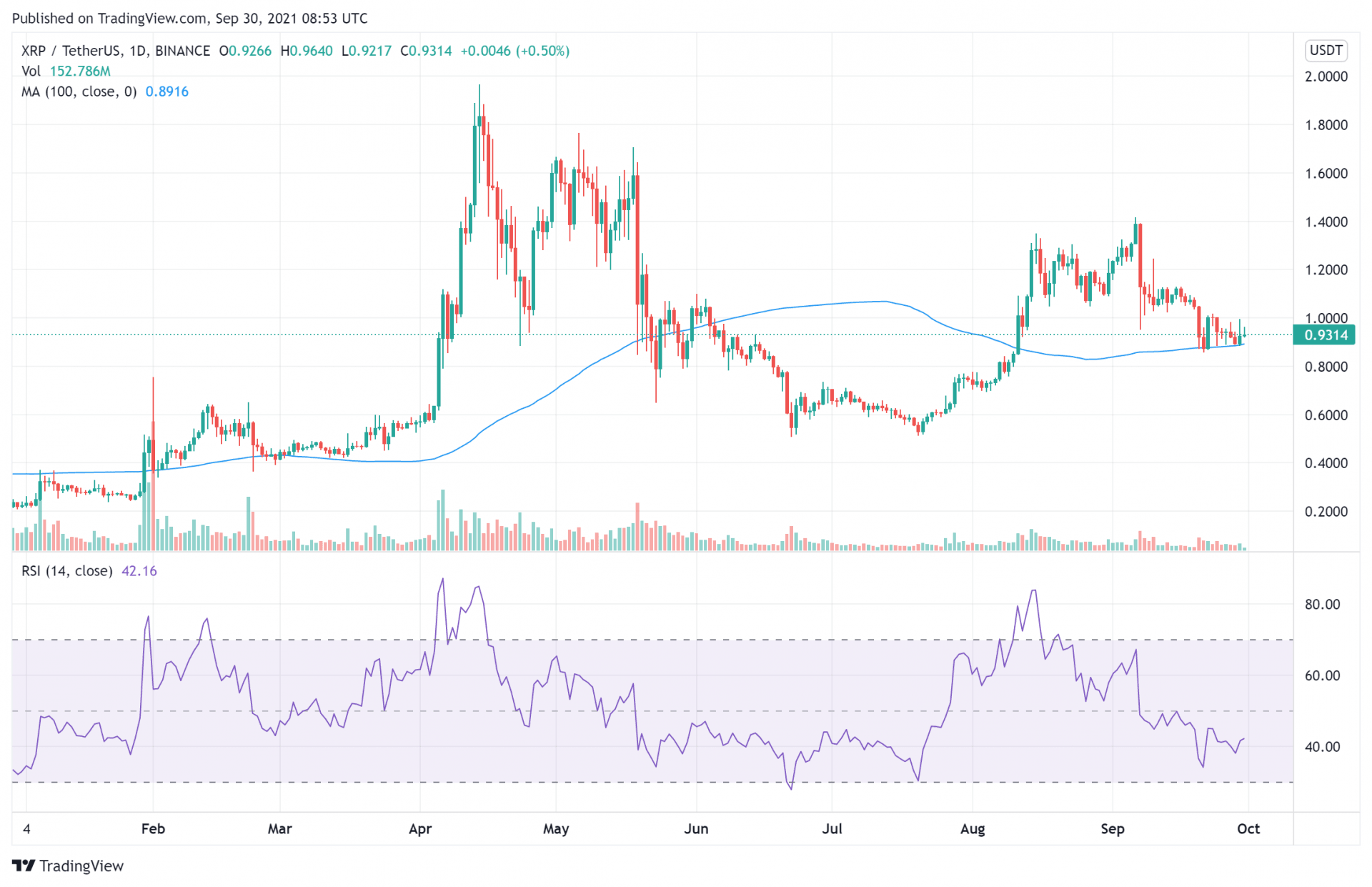

These ETPs can have a combination of regular equities, not only the U.S. stock exchange but really any stock exchange, as well as crypto-assets like bitcoin (BTC). So the ETPs get minted and are available for anyone to purchase, not just people using the dapp either as the tokens are publicly available.

Another product we offer is single stocks, these are tokenized synthetic assets. So you can get stocks like Apple, Microsoft, or whatever type of stock you want. Individual stocks that trade 24/7 and they are available all over the world. We’re also unleashing tokenized stocks that are not synthetics. Someone goes out and purchases the underlying share, passes the dividend rights, voting rights, and all that stuff to the user. That one will be trading 20 hours a day and seven days a week.

BCN: Why do you think there’s a big influx of retail investors getting into the traditional stock market today and many flocking to crypto markets too?

JR: The trends have been there for a long time. They have already been pointing out with hard facts the exponential growth of retail participants getting into the stock market and into crypto. I think there were a couple of catalysts that accelerated that pre-existing trend. We were going to get here anyway but we got here a lot faster thanks to coronavirus.

They put everyone in quarantine and turned off all entertainment, sports or whatever, and people look for something else to do. So whether they turn to it for entertainment or to make money, they turned to the stock market which is one of the few things that was available.

The second catalyst, like what we saw with Gamestop earlier this year, put the spotlight on Wallstreetbets giving people the impression that Wallstreetbets is where retail people, without really any professional training or anything, can get involved with the stock market.

I think that was a very inviting moment where it lifted the veil of sophistication and it showed, in a digestible entertaining manner, what it is like to participate in the stock market.

BCN: Some people say the stock market is in a bubble. How do you feel about that description?

JR: I don’t know that we’re in a bubble, the economy is a cycle and it goes up, and then it goes down. We’ve been in an uptrend for like 10-15 years, so I guess at some point stocks are going to go back down. I wouldn’t say that it’s a bubble because you gave a lot of participants that are flowing in and they are flowing in with various amounts of money. I think the market share just increased at this point.

People have been screaming forever that the Fed has been printing money and that’s why the stocks go up. Maybe that’s the case, but they’re still printing money and the stocks continue to go up. It’s gonna happen until it stops happening.

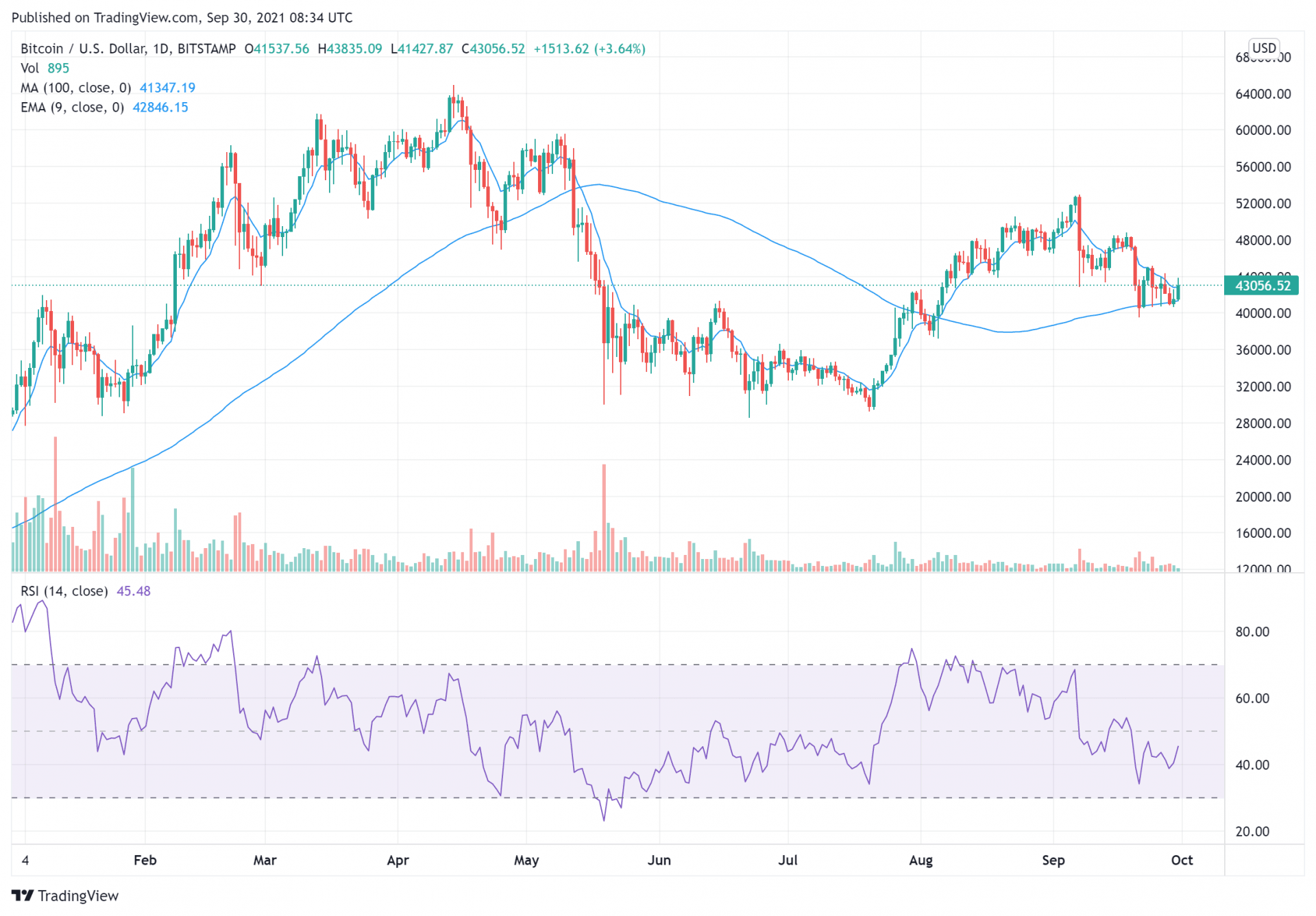

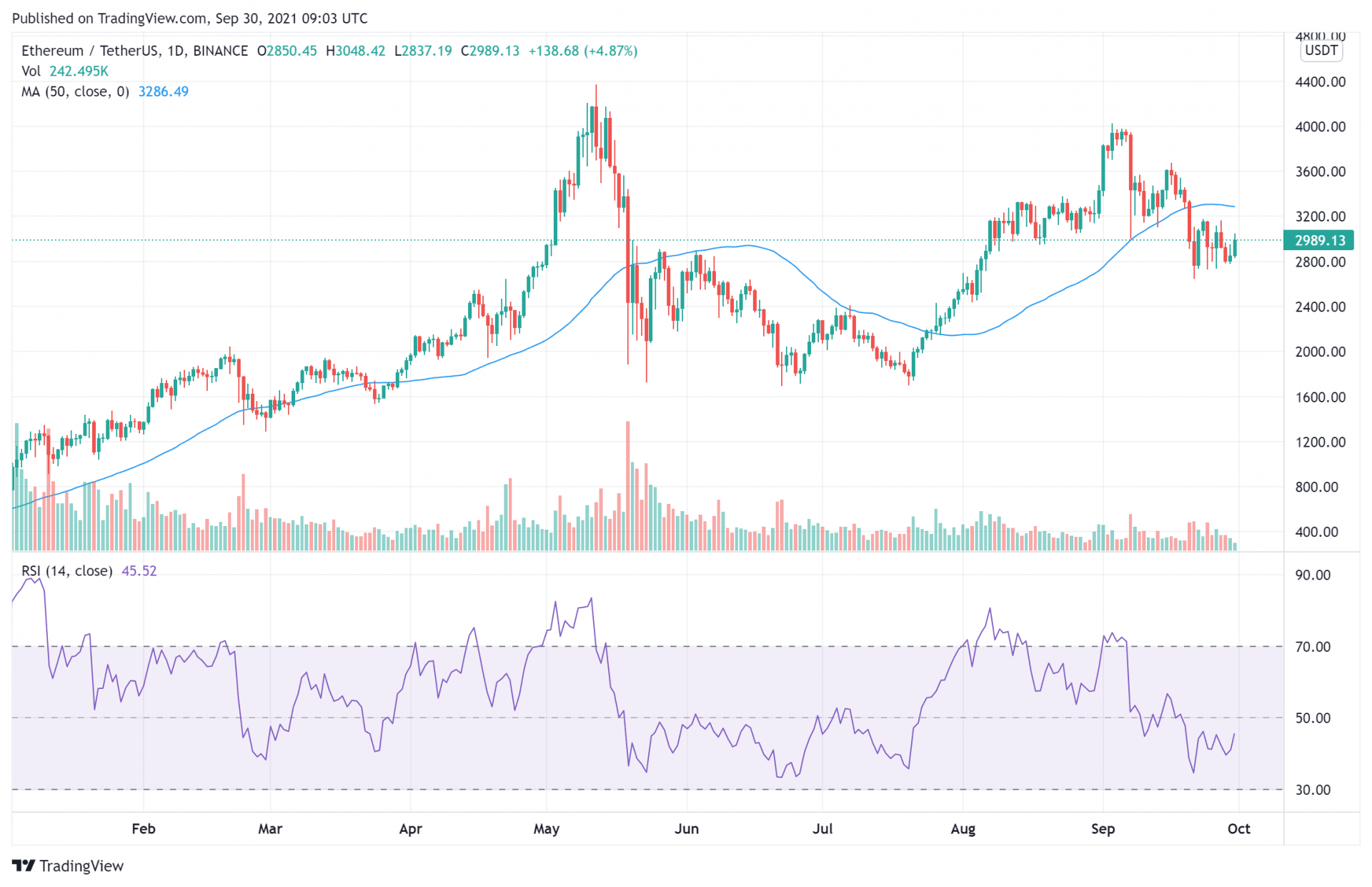

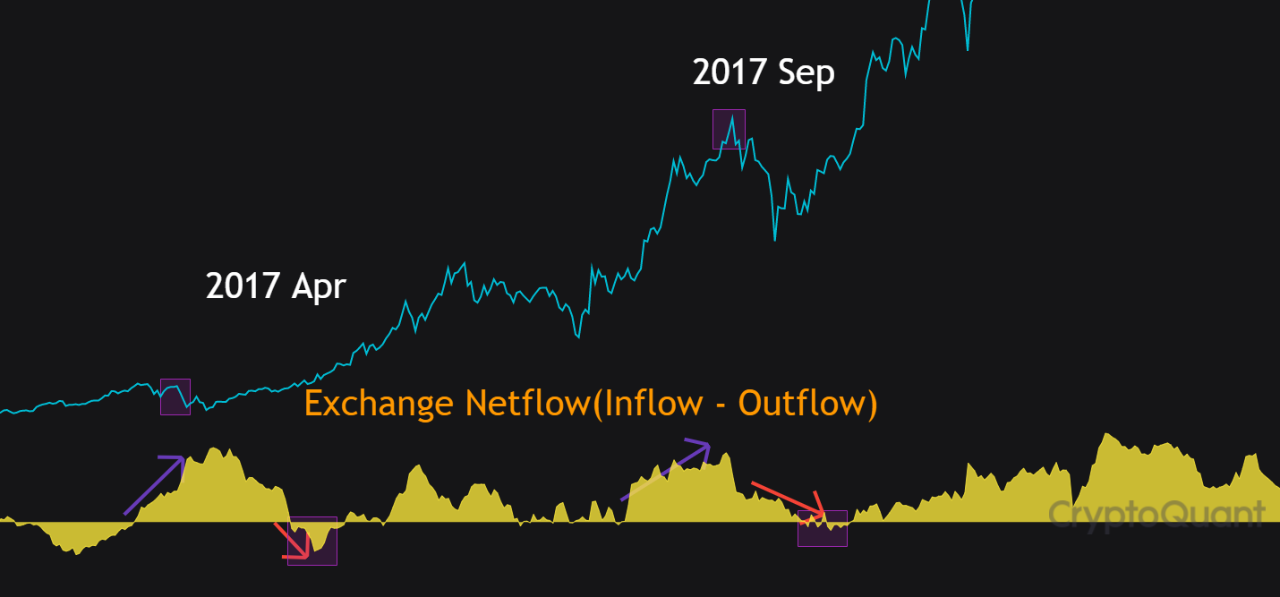

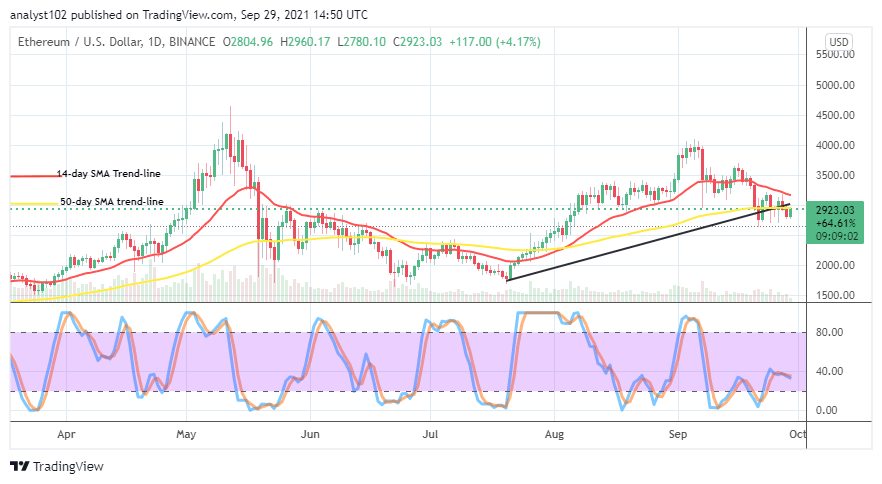

The same thing goes on in the crypto world I think. It goes in cycles, we’ve had a few bullish years and then we had some bearish years, and now kind of on a bull run. When exactly the cycle switches I don’t really know. It’s impossible to predict, we know that it will happen, and when it happens, it will recover again.

WSB Founder: ‘It’s Inevitable That Traditional Finance and Crypto Finance Are Merging’

BCN: Recently, the WSBdapp team released NFTs. Can you tell our readers about the WSB NFTs?

JR: With the NFTs, coming from a real traditional finance background, wanting to get into the NFTs for me was an exercise of like let’s give these things utility. Let’s make these things kinda like membership tokens. Where people purchase these tokens and get access to all sorts of benefits within our ecosystem. Like increased percentages on yield, or providing liquidity, access to special rooms, access to additional airdrops that were gonna be thrown out there with additional NFTs.

That’s my personal vision, but the team that I am working with has their perspective on the NFTs, and they say well that’s great we’ll put all that stuff there but we like the pictures, the profiles, and people really like the artwork behind it. So we’re also making sure that it has that artwork component to it. People can buy right now and basically it’s like a raffle, a maneuver to lower the gas fees to get the Diamond Hands NFT. Once people have that they will get an airdrop of additional ones that we’ve mapped out.

BCN: Were you familiar with blockchain and crypto-assets like bitcoin before WSB’s massive growth?

JR: When bitcoin first started I was aware of it and later I mined some coins and played around with it. It was really cumbersome to get involved so I became more of an observer of bitcoin and hoped that it would be adopted and become mainstream. Sure enough, it did, and the price started going up. Then at that point, it’s like a regular asset with the supply and demand and the price that gets spit out as a function of that.

I stopped paying attention to crypto for a few years. I saw that new coins would come out and read a little bit about them and said ok cool, this is a different protocol. They figured out ways around certain inefficiencies and I hadn’t realized just how powerful the world of defi had become.

Even still when I tell people I’m doing things with defi, a non crypto person’s initial reaction is are you bullish bitcoin. These defi protocols are so much more than just coins. My imagination runs wild with possibilities. It’s also inevitable that traditional finance and crypto finance are merging. We’re already seeing them spill over into each other.

BCN: In recent times, regulators have had their sights set on decentralized finance. Do you think U.S. regulators will come down on defi?

JR: I don’t know. I wouldn’t use the words come down. Right now it feels that way and antagonistic. I’m hoping the regulators learn about defi and because it legitimizes it. Right now it’s really difficult without a framework to work with. Any person that’s getting involved with this is taking a chance that it might go away or might change.

I do believe the regulators have the best interest at heart. As far as we are concerned with Wallstreetbets, we are super-positioned for regulation. Everything we do, we’re going above and beyond with audits and legal opinions, and we’re trying to anticipate what these rules might look like.