Data suggests $34,000 was the bottom and BTC’s recent performance could be a sign that traders are beginning to open fresh longs.

Cryptocurrencies had a volatile week after Bitcoin’s (BTC) sudden crash to $33,000 on Jan. 24. However, the sharp 9% drop fully recovered within 8 hours after BTC price regained the $36,000 support.

On Jan. 26, Bitcoin rallied to $38,960 but it could not sustain the level and corrected by 8.8% in the following 8 hours. When factoring in the recent ups and downs, Bitcoin managed to only gain a meager 1.6% over the past seven days.

Even with the considerable price swings, the aggregate futures contracts liquidations were relatively low. Longs (buyers) had $570 million futures terminated, while shorts (sellers) faced $690 million. Data shows that Bitcoin futures represented 41% of the total $1.25 billion liquidations.

Regulatory winds could be limiting BTC’s price recovery

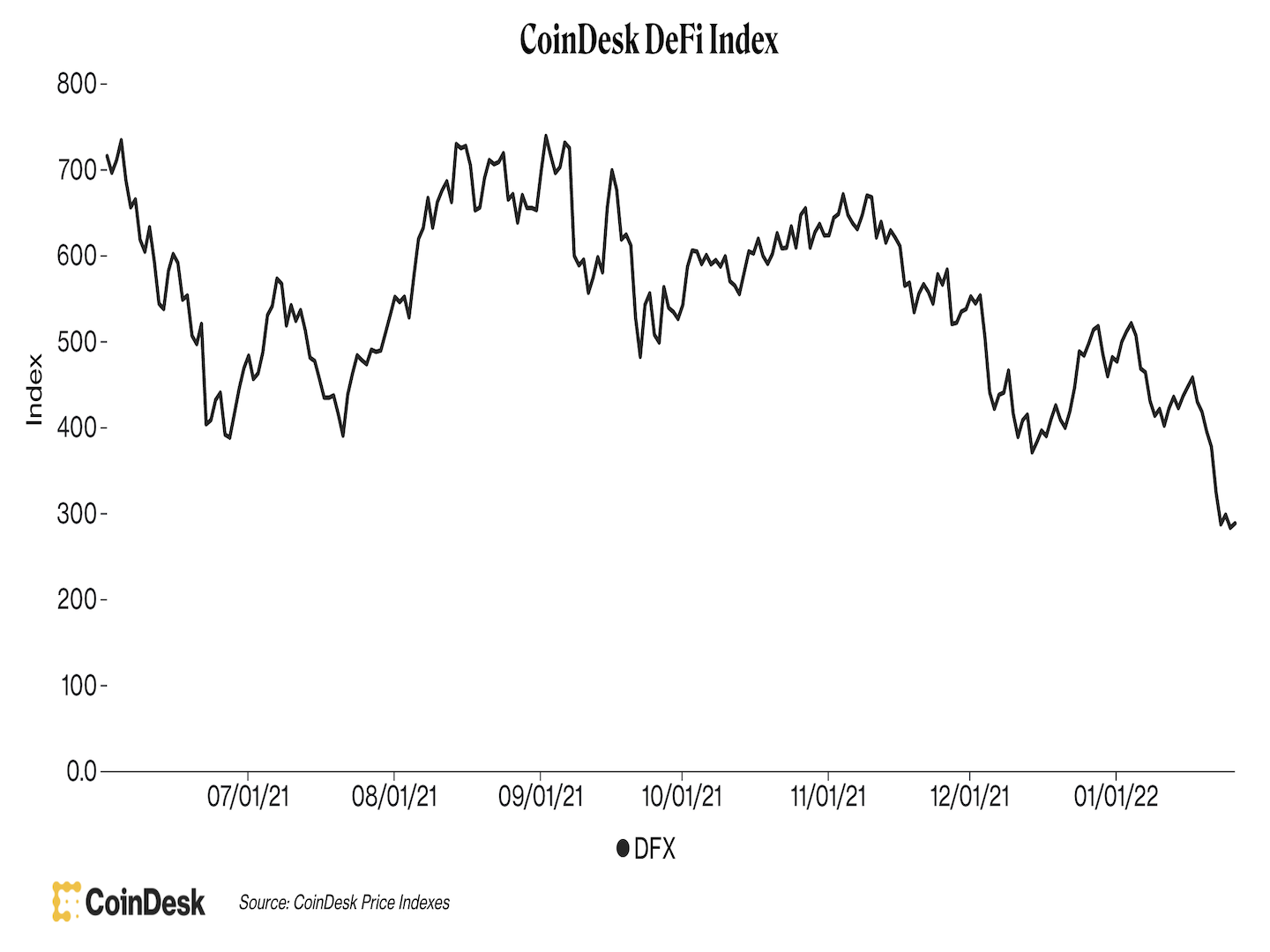

The total crypto market capitalization presented a modest 1.6% weekly increase, in line with Bitcoin’s performance.

Notice how the Jan. 24 price is forming higher lows and currently shows support at $1.75 trillion. Even with the price being 22% down in 2022, the total crypto market capitalization showed a healthy 12.5% bounce since the Jan. 24 low.

Investors seem to be digesting this week’s regulatory news where United States Congressman Ted Budd submitted an amendment to scrub a bill provision allowing the U.S. Treasury to unilaterally prohibit certain financial transactions without public input.

If passed in its current form, the America COMPETES Act of 2022 would result in a significant blow to the cryptocurrency industry, as Coin Center’s executive director Jerry Brito stated.

Investors were negatively impacted by news that the U.S. White House is reportedly preparing an executive order on crypto to make government agencies conduct risk analysis on cryptocurrency as a national security threat.

Metaverse tokens decoupled after last week’s Apple news

Steady bearish newsflow might have been the cause for cryptocurrencies’ recent price action but there were some stellar performances from Metaverse tokens.

Apple (AAPL) CEO, Tim Cook, said in an investors’ call on Jan. 27 that metaverse applications have a lot of potential and that his company is investing in augmented reality developments on its devices.

The news was enough to catapult metaverse-related tokens by up to 36%, including Flow, The Sandbox (SAND), Decentraland (MANA), Enjin Coin (ENJ), and Arweare (AR).

On the other hand, Terra (LUNA) was impacted after the Avalanche-based reserve currency Wonderland Money (TIME) announced that a pending proposal would determine whether the project closes up shop or not. As a result, the MIM stablecoin dipped below 1.00 and some speculate that this may have had a knock-on effect on Terra’s LUNA and UST token.

Scalability and interoperability blockchain solutions Cosmos (ATOM), Fantom (FTM), and Harmony (ONE) presented negative performances after the Ethereum hash rate surpassed 1.11 PH/s, its highest level ever registered. A higher hash rate indicates that more miners are joining the network, which helps to cement blockchain security.

Tether premium and CME futures showed improvement

The OKEx Tether (USDT) premium measures the difference between China-based peer-to-peer (P2P) trades and the official U.S. dollar. Figures above 100% indicate excessive demand for cryptocurrency investing. On the other hand, a 5% discount usually indicates heavy selling activity.

The Tether indicator continued to display strength as it stood above 99% over the past seven days. That is in stark contrast to three weeks ago when panic selling from China-based traders drove the indicator to a 4% discount.

To confirm that the crypto market structure has improved, traders should analyze the CME’s Bitcoin futures contracts premium. This metric analyzes the difference between longer-term futures contracts to the current spot price in regular markets.

Whenever this indicator fades or turns negative (backwardation), it suggests that there is bearish sentiment.

These fixed-month contracts usually trade at a slight premium, indicating that sellers request more money to withhold settlements for longer. As a result, futures should trade at a 0.5% to 2% premium in healthy markets, a situation known as contango.

Notice how the indicator flirted with the backwardation from Jan. 18 to 24 as Bitcoin dipped below $42,000. However, as BTC showed signals that $33,000 could have been a local bottom, the futures markets recovered a healthy 0.5% premium.

Considering that the aggregate cryptocurrency market capitalization is down 22% in 2022, the market structure looks primed for a recovery.

Barring a significant change in these fundamentals, Bitcoin bulls are probably beginning to feel comfortable adding positions below $40,000.