- Bitcoin price started a downside correction below USD 44,000.

- Ethereum declined below USD 3,100, XRP is still well above USD 0.80.

- LEO trimmed gains after skyrocketing yesterday, while LRC, NEAR, and AR are down over 7%.

Bitcoin price spiked above the USD 45,000 resistance zone before the bears appeared. BTC topped near USD 45,300 and started a downside correction. It is currently (04:23 UTC) trading near USD 43,500 and might test the USD 42,750 support.

Similarly, most major altcoins are also moving lower. ETH spiked above USD 3,200 before there was a drop below USD 3,100. XRP is now consolidating gains near the USD 0.85 level. ADA is down 6% and trading near USD 1.15.

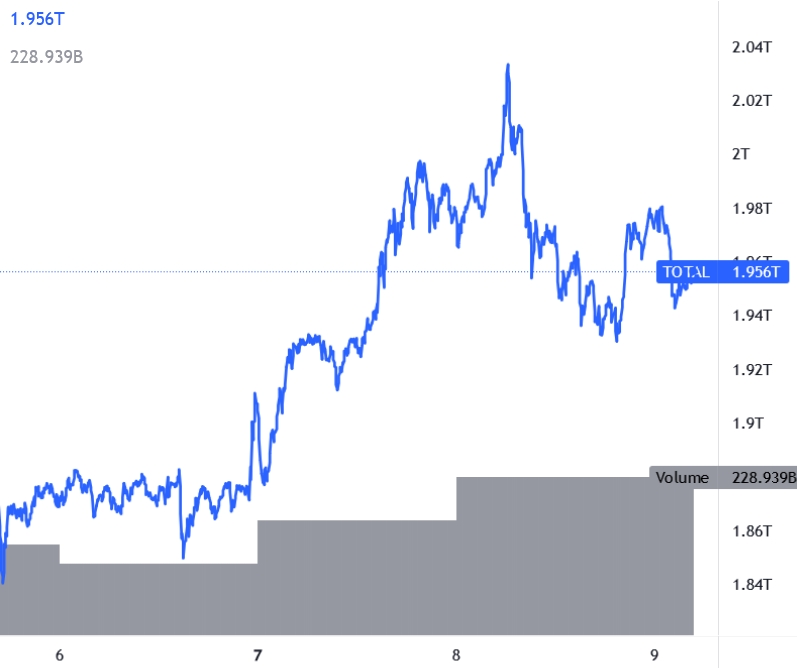

Total market capitalization

Bitcoin price

After facing resistance near USD 45,500, bitcoin price started a downside correction and there was a move below the USD 43,000 level before recovering higher. On the downside, an immediate support is near the USD 43,000 level. The next key support is near the USD 42,750 level, below which the price might drop to USD 42,000.

On the upside, an initial resistance is near USD 43,850. The next major resistance is near the USD 44,000 level, above which the bulls might retest USD 45,000.

Ethereum price

Ethereum price also attempted a clear move above USD 3,200 resistance but failed. As a result, ETH started a downside correction below USD 3,100 and might test the USD 3,040 support. The next major support is near USD 3,000, below which there is a risk of a sharp decline.

If there is another increase, the price might face resistance near USD 3,150. The next key resistance is still near USD 3,200.

ADA, BNB, SOL, DOGE, and XRP price

Cardano (ADA) is down 6% and trading well below USD 1.20. It is approaching the USD 1.15 support. If there is a downside break, the price might slide towards USD 1.12. The next major support is near the USD 1.08 level.

Binance coin (BNB) is also down almost 6% and trading below USD 420. It might soon test the USD 400 support zone. If the bulls fail to protect USD 400, the price might decline towards the USD 385 support.

Solana (SOL) is moving lower towards the USD 110 level. The next key support is near USD 105. A clear move below USD 105 may possibly push the price below the USD 100 support.

DOGE spiked towards the USD 0.175 level before it started a downside correction. The price is heading towards USD 0.150. If there are additional losses, DOGE might test the USD 0.142 support in the coming sessions.

XRP price is trading near the USD 0.85 level. An immediate support is near the USD 0.82 level, below which the price might test USD 0.80. If not, it might revisit the USD 0.90 resistance zone.

Other altcoins market today

Many altcoins are down over 5%, including LUNA, DOT, SHIB, MATIC, ATOM, LINK, NEAR, UNI, ALGO, BCH, FMT, and XLM. Conversely, LEO is still up almost 56% and trading near USD 7.50, after it hit its new all-time high of USD 8.14 (per Coingecko) following the Bitfinex news.

Overall, bitcoin price is correcting gains from well above USD 45,000. If BTC remains above USD 42,750, it could start a fresh increase in the coming sessions.