Introduction

As EIP-1559 draws closer and some Ethereum projects are just beginning to adopt Layer-2 technology, it is clear that the dire need for cheap and ultra-fast transactions has driven some to explore alternative networks such as Polygon, formerly known as Matic.

Interestingly, only a minuscule amount of Ethereum addresses have interacted with the sidechain. Based on data by Nansen, only less than 0.1% of addresses on the Ethereum mainnet are also on Polygon. This represents a highly untapped opportunity, ripe for a Cambrian explosion of growth and yield-farming activity.

In this article, join us as we bring you this step-by-step guide on how to dive right into the Polygon blockchain. From setting up your wallet to bridging your funds, we will also touch on some of the existing protocols where you can start putting your assets to work.

How To Get Started

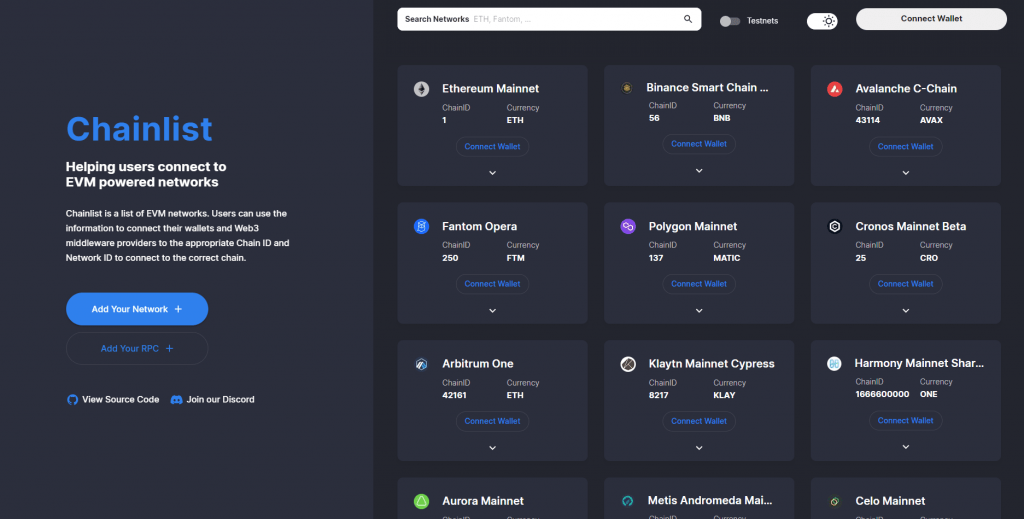

Before you embark on your journey, you would need a wallet to store your funds. Like most EVM-compatible blockchains, you can easily add the Polygon network to your existing MetaMask wallet by heading to chainlist.org and selecting the Matic Mainnet.

How To Add Polygon to MetaMask

Step 1: Head to https://chainlist.org/ and connect your wallet.

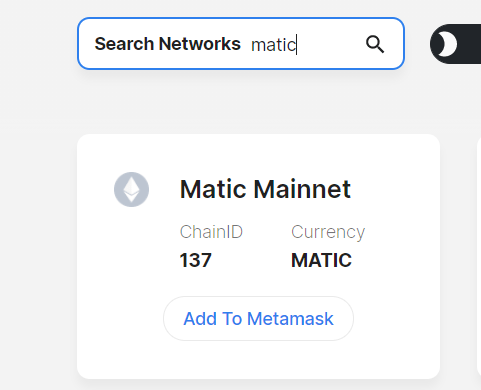

Step 2: Search for Matic and click add to MetaMask.

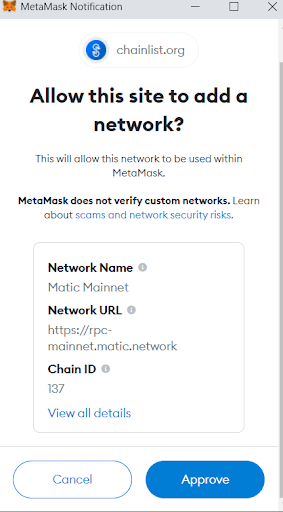

Step 3: You will receive a prompt from MetaMask to allow the site to add the network. Click on Approve.

Congratulations, you have successfully set up the Polygon network on your MetaMask wallet!

Do note that this is just one of the more efficient ways to get started. If you wish to do it manually, you can add a custom RPC on MetaMask according to the network specifications listed in the documentation here. Although it is unnecessary, we highly recommend having a second network with a backup RPC in place, just in case your transactions are not going through.

Now that you have set up your wallet, it’s time to start loading it up with funds. Some of the methods that you can use to transfer your assets are via withdrawal from AscendEx (formerly BitMax) directly to the Polygon network, or by sending funds through the Matic PoS Bridge, or by using Xpollinate.

- Transferring from AscendEx

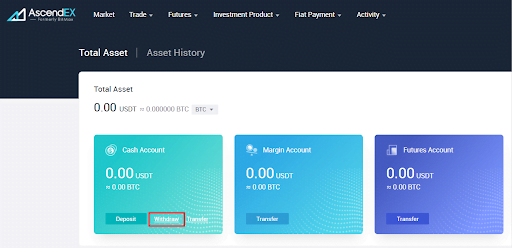

Step 1: If you have funds in AscendEx, log onto your account and head over to your assets to view your balances. If you do not have any available funds, you may deposit some by clicking on ‘Deposit’ and choosing the token.

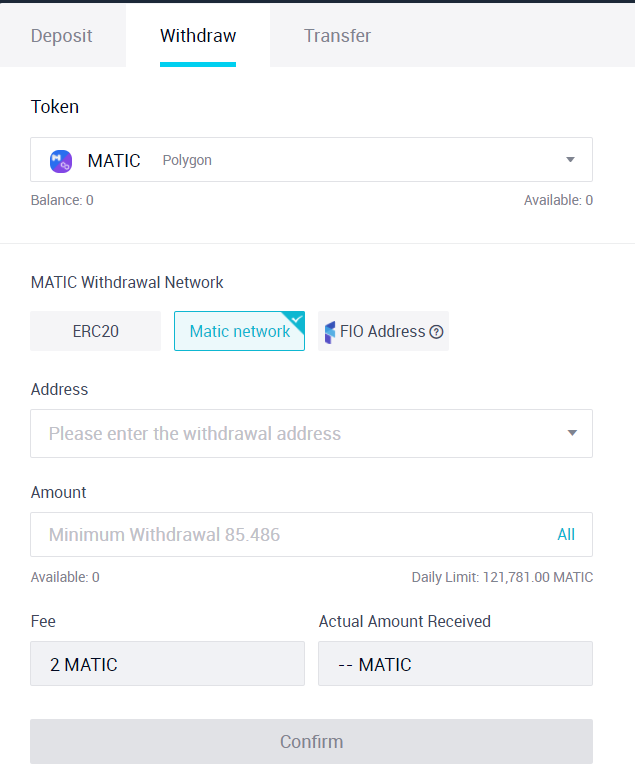

Step 2: After clicking on withdraw, select your asset for withdrawal. Note that you can only withdraw MATIC, USDC, and ROUTE to the Polygon network.

Step 3: Once you have chosen your asset, select the Matic network as your preferred withdrawal network. Enter your withdrawal address and the withdrawal amount. Once you’re done, click ‘Confirm’. Once the withdrawal request has been completed, ensure that the funds are safely in the address you specified. Note that new users are unable to withdraw in the first 24 hours upon account creation.

And that’s it, you should be able to start yield-farming immediately! But maybe you don’t want to go through a centralized exchange, and would much rather control the movement of your own funds. Well, fret not as there are a couple of decentralized bridges to transfer your funds over.

- Transferring from Ethereum via Matic Bridge

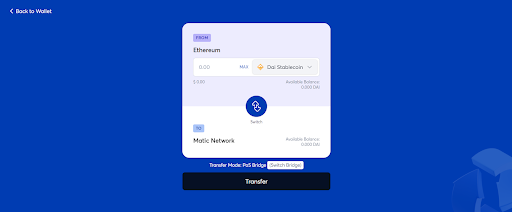

Step 1: To deposit from Ethereum, connect to the Polygon network and head to https://wallet.matic.network/bridge/.

Note that for different assets, there are different bridges that you can use to transfer your funds. To switch bridges, click on ‘Switch Bridge’ next to the Transfer Mode, below the swap interface.

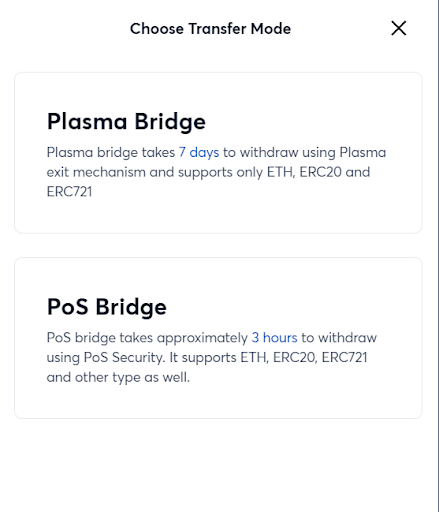

Different bridges will have different withdrawal times and supported assets as shown below.

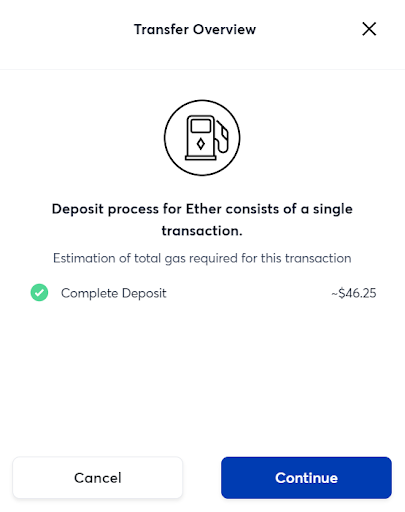

Step 3: Select your asset that you would like to transfer and click on ‘Transfer’. You will receive a prompt showing you what’s supported and what’s not supported on the bridge. Proceed by clicking ‘Continue’ and you will be shown the estimated gas fees that need to be paid to complete the transaction.

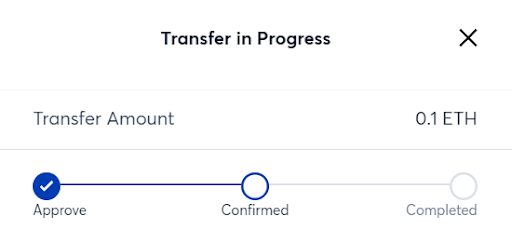

Step 4: Click ‘Continue’ and you will receive a summary of your transaction. Verify that the details are correct and proceed. You will then receive a MetaMask prompt to confirm the transaction. After confirmation, you can view the progress of your transaction. Note that the funds will be sent to the exact same address used to initiate the transaction but on the Polygon network.

- Transferring from xDAI via Xpollinate

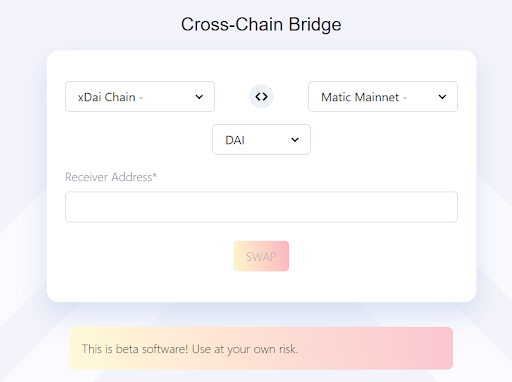

Step 1: Alternatively, you may choose to port over your funds from xDai via Xpollinate. Head over to https://www.xpollinate.io/ and switch to your chosen network.

Step 2: Select the asset that you would like to transfer and input the receiver’s address. Once you’ve done that, click on ‘Swap’. Note that this bridge currently supports only DAI, USDC, and USDT.

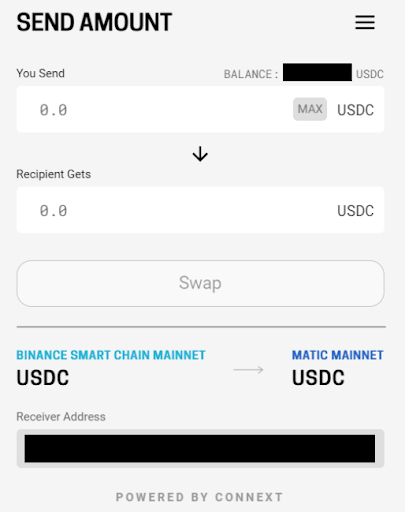

Step 3: You will then receive a prompt to login to Connext while the bridge sets up channels to perform the transfer. Next, a swap interface will pop up where you can enter the amount that you would to port over. Once you’re done, click on ‘Swap’

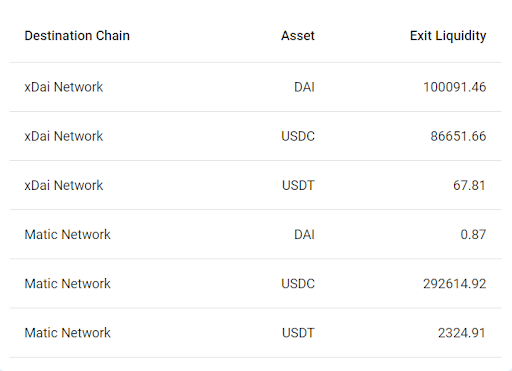

Step 4: Wait for the transfer to complete and you should be able to see your assets on Polygon. Note that this bridge may not always be available depending on the existing liquidity on each side. You can view the amount of exit liquidity available to perform transfers below the interface on the main site.

And there’s all there is to it! Now you’re all geared up to begin farming those juicy yields on the polygon. But wait, here are a few things you need to be aware of before you begin your journey.

Like most dApps on other blockchains, transactions are paid for using the network’s native token. In this case, you would need to transfer some MATIC, but even 1 MATIC can last you for thousands of transactions.

For instance, with MATIC currently sitting around $1, most transactions require a gas price of only 1 gwei, meaning you would pay less than a tenth of a cent to approve, transfer or swap your assets on Polygon. As you can see, this greatly benefits smaller farmers with lower capital since transaction fees are no longer an entry barrier, as is usually the case on Ethereum.

Yield Farms

With the basics covered, let’s talk about the current state of Polygon. Although big names such as Aave, Curve, and SushiSwap have expanded their reach into the ecosystem, many other unique and colorful yield-farming platforms have emerged in rapid succession, creating a constant stream of opportunities for the avid yield farmer.

Although the number of existing projects is not as substantial when compared to Ethereum or Binance Smart Chain, we have divided them into a few categories – lending platforms, decentralized exchanges, yield aggregators, and other notable farms. Do note that this is not an exhaustive list, but they are a good place to start for newcomers coming into Polygon.

Lending Platforms

One of the largest lending platforms on Ethereum, Aave has since launched its platform on Polygon, with over $3 billion in Total Value Locked (TVL). The platform allows users to deposit their assets to receive amTokens (Aave Matic Market tokens) which can be used as collateral to borrow other assets or to summon Aavegotchis. (More on Aavegotchis below)

Aave has been the pioneer behind new lending primitives like rate switching and flash loans, allowing for greater flexibility with your capital. Additionally, the platform provides both variable and stable interest rates as well as the ability to switch between them.

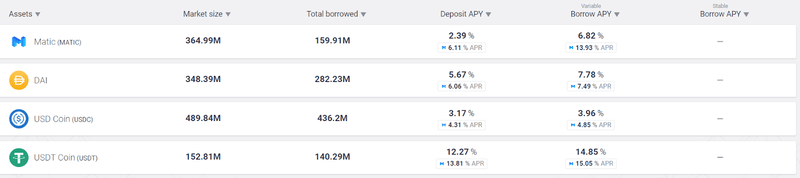

Interest rates on deposits may vary based on the supply and demand for borrowing. In general, higher demand for borrowing or lower supply for lending will push interest rates higher, allowing depositors to earn a higher APY. Currently, depositors and borrowers will receive additional MATIC rewards on Polygon, thus boosting the returns even more. Although the base rewards are received directly into your wallet, the MATIC rewards would need to be claimed from your dashboard.

As of the time of writing, Aave only supports 7 assets on Polygon. However, they are offering fairly decent rates on stablecoins, with up to 25% APR on stablecoins such as USDT.

Decentralized Exchanges

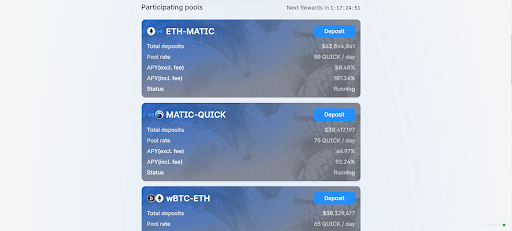

Most of the native decentralized exchanges (DEXs) on Polygon, such as Quickswap and ComethSwap are essentially forks of Uniswap, albeit with different fee structures and additional features. Quickswap charges a 0.25% trading fee which is distributed to liquidity providers while Comethswap charges a much higher trading fee of 0.5%. However, only 90% of that fee goes to liquidity providers while the remainder is sent to players of their blockchain game, Cometh.

Both platforms feature incentivized liquidity mining pools where liquidity providers can stake their LP tokens to earn QUICK or MUST. Yields for Quickswap’s liquidity mining program are currently ranging from 30% on stablecoins to 200% on QUICK pairs. Since liquidity provision is required, you would have to consider the risk of impermanence loss.

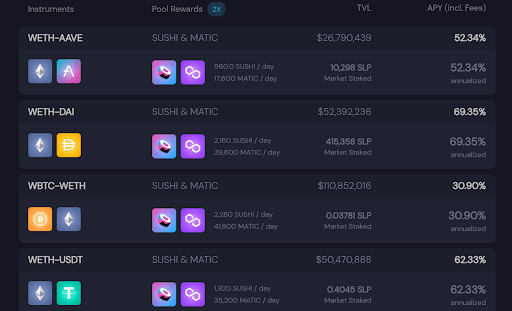

Besides the native AMMs that reside on Polygon, projects that began life on Ethereum such as Sushiswap and Curve, are starting to take their first steps towards a multichain future. Sushiswap has ported over their entire suite of decentralized applications, allowing users to not only use the SushiSwap AMM, but also their Kashi lending and leverage services.

In a joint collaboration with Polygon, the protocol is now offering SUSHI and MATIC rewards for providing liquidity for any of the 6 major initial pairs on their exchange, which include WETH-DAI and WETH-AAVE. The Sushi LP tokens received would then have to be staked on the platform to earn these rewards.

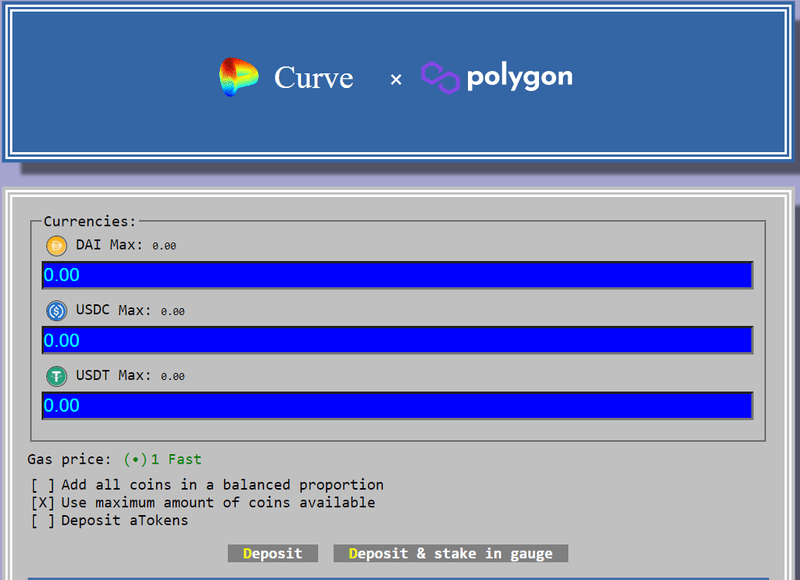

Similarly, Curve is also offering MATIC rewards on top of their base yield for stablecoins. Unlike the version on Ethereum where there are multiple pools to choose from such as the Y pool or the 3pool, there is currently only the Aave pool on Polygon, which supports DAI, USDC, and USDT deposits.

After depositing any of the three stablecoins, users will receive am3CRV tokens, representing their share of the pool. You can also view your total daily, weekly, and monthly profits over time as well as your claimable tokens using Curve’s dashboard.

Yield Aggregators

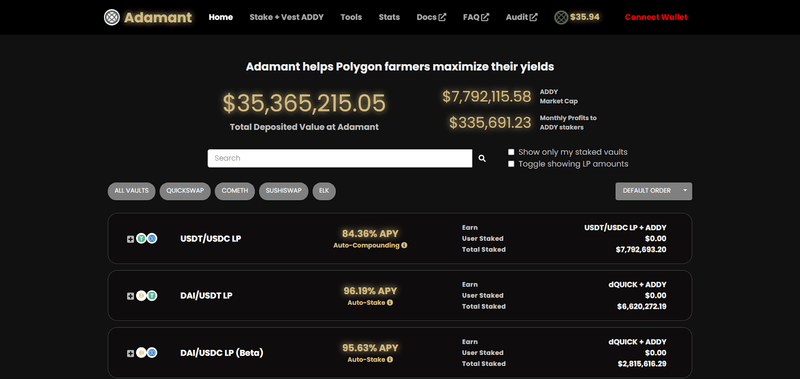

Just like Yearn Finance or Pancake Bunny, Polygon too has its own yield aggregators that help to auto-compound users’ deposits to maximize returns by forming an army of farmers that pool their resources to seek the best yields collectively. Examples of these protocols include Adamant Finance, Stake Dao, and Beefy Finance.

These platforms may vary in terms of the fees they charge as well as other additional mechanisms in play. For example, Adamant charges a 30% performance fee, but you will receive 500 ADDY tokens for every 1 ETH in fees collected. On the other hand, Beefy Finance charges just 4.5% and a variable withdrawal fee from 0.05% to 0.1%.

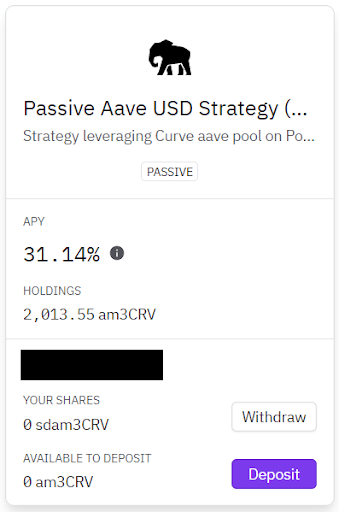

While Adamant and Beefy are more focused on compounding the underlying LP tokens, single-asset stakers may choose to deposit into StakeDao instead, although they currently have only one strategy in place which leverages the Aave stablecoin pool on Curve.

Other Notable Farms

- Aavegotchi

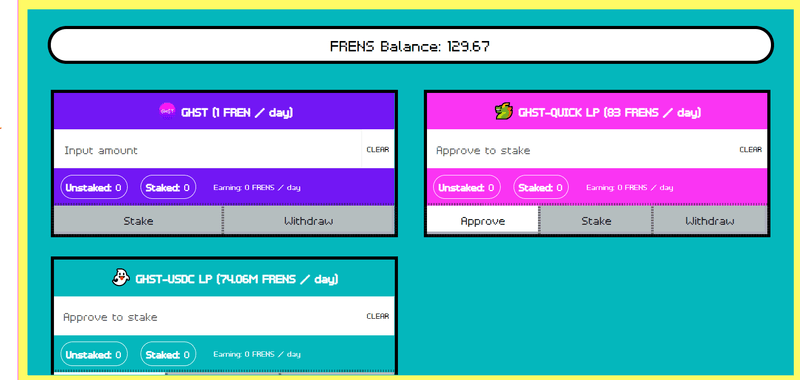

Unlike conventional farms, Aavegotchi lets you stake your GHST or GHST LP tokens to earn FRENs, which cannot be traded but can be converted into raffle tickets. You can use these tickets to enter raffle events where you can win valuable prizes. Think of it as a yield farm with a highly variable rate of return. You win big if you win the raffle but go home empty-handed otherwise.

- Mai Finance

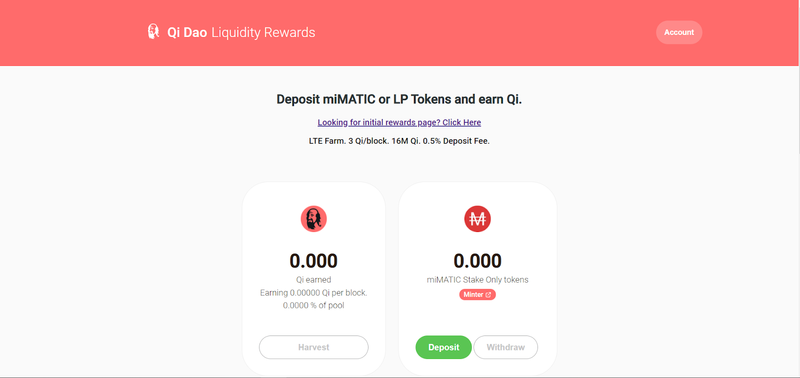

Similar to the over-collateralized vault mechanism used by Maker in the creation of Dai, Mai Finance emulates this concept using MATIC tokens as the collateral instead. Users can mint miMATIC tokens by taking on a collateralized debt position with a collateral-to-debt ratio of up to 150%. You can then stake the miMATIC tokens or provide liquidity for them to earn Qi tokens – the governance token of the stablecoin protocol under Mai, known as Qi Dao.

- Poly Farms

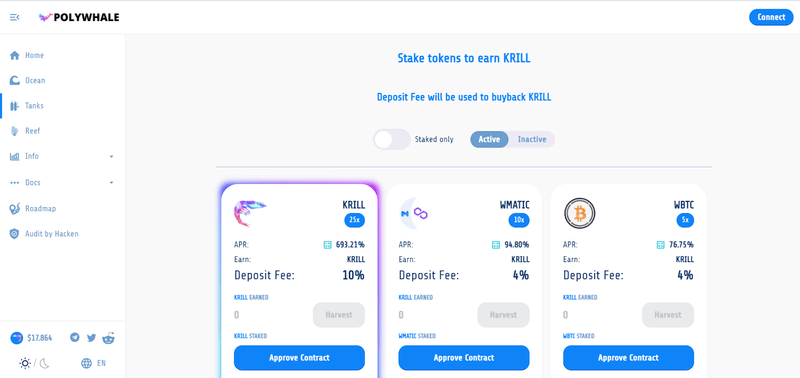

Characterized by the word ‘Poly’ followed by an animal name such as Polywhale or Polyfox, these yield farms generally implement the same ‘buyback and burn’ mechanism, where deposit fees from single asset pools are used to repurchase the native token of the platform.

Although the deposit fees may vary across different iterations, some have an additional deflationary mechanism that burns a specific percentage for each token interaction. For example, Polyfox charges a 1% tax on each transaction such as buying, selling, or farming.

Final Thoughts

As evidenced by Aave and Curve, large players are beginning to pave the way for many established projects to spread the roots across the bridge. With more and more projects popping up in the Polygon ecosystem, the yield farming scene shows no signs of slowing down for both retail players and veterans alike.

However, as is the norm with many new and exciting territories to explore, danger lurks around every corner. With even lower costs and a growing crowd, malicious actors are more than ready to prey on unsuspecting users who aren’t too careful. Always do your research and only invest what you are willing to lose on your adventures. With that in mind, we hope that this guide has shown you the basics of navigating the uncharted path of yield farming on Polygon. Stay safe and happy farming!