- NFTs have already given rise to new types of copyright infringement, frustrating artists.

- In the bigger picture, the problems could be offset by new revenue streams.

If there was a contest for acronym of the year, “NFT” would be the clear favorite for 2021. Short for non-fungible tokens, NFTs are having a moment as fans scramble to “own” pieces of digital art or pop culture moments.

While many people are baffled by the trend, no one can deny it’s been lucrative. In recent weeks, buyers have laid down millions of dollars to acquire NFTs issued by the likes of the artist Beeple and the musician Grimes.

But along with the money and hype, the NFT craze has spurred a debate over what it means to own digital property, and the role of copyright on the Internet. Some suggest NFTs might soothe long-running tensions between creators and tech platforms—while others point out the trend has already given rise to new forms of piracy and rip-offs.

What exactly are people buying?

NFTs are not new. They’ve been around since 2017 when a company called Dapper Labs began selling NFTs in the form of unique digital cat cartoons called CryptoKitties. Those kitties were the subject of a short-lived craze, and some sold for tens of thousands of dollars before the fad quickly fizzled. Now, in 2021, NFTs have come roaring back as the phenomenon has expanded well beyond digital cats.

Today, the range of NFTs for sale includes just about anything that can be captured as a digital file. The band Kings of Leon, for instance, dropped NFT versions of their new album, while the NBA is selling NFT basketball highlights. An original work by street artist Banksy has been burned and turned into an NFT. And last week, the bidding for an NFT of Twitter founder Jack Dorsey’s first tweet topped $2 million.

All of this raises the question of just what are people buying? After all, any of these NFT artifacts can be easily copied—legally or otherwise—by anyone with an Internet connection and a basic familiarity with software. Why pay to “own” Jack Dorsey’s tweet when you can print out or embed the same tweet on a website like I’ve done below?

NFT enthusiasts will tell you that the artifact they bought might look (or sound) identical to copies on the Internet, but their version comes with a unique ownership certificate. That certificate is inscribed on a blockchain to create a tamper-proof transaction record to show the world that the artwork—or song or sports highlight—belongs to someone. Think of it as a serial number or a signature from the artist.

What this means, at least to NFT boosters, is that they own something unique. Just as an original painting signed by a famous artist is worth millions, even though thousands of college students tape the same image to their dorm room, NFT owners claim that their piece of digital art is the “real” one.

Nonetheless, NFT owners might be surprised to discover that what they “own” is rather limited.

As law professors like to tell their students, property is like a bundle of sticks. Each stick in the bundle represents a right to do something, such as the right to sell the piece of property, or harvest it or destroy it, and so on. This is certainly true of copyright, which contains more sticks in its bundle—such as the right to broadcast and merchandise an image—than many people realize.

In the case of sports leagues and musical acts, lawyers are taking pains to ensure their clients keep most of the ownership sticks in the copyright bundle for themselves. For fans, what they receive when buying an NFT is a license that lets them do little beyond display or transfer the work. Purchasers of NFTs issued by the NBA—called “Moments”—can’t, for instance, modify the highlight they buy, or display it in a way the league considers hateful or offensive.

Some of these limits go beyond those that go with owning a physical pack of sports cards. In the case of those physical cards—which the NBA likes to invoke as a comparison to NFTs—the owner is free to draw mustaches on the players, or glue the card to a controversial collage. This might not be the case with NFTs. One can imagine a situation in which pro-democracy activists use their NFTs to call attention to the NBA’s attempts to cozy up to China, and the league responds by deleting the NFTs.

There are limits to what you can do with a physical card too, of course. Sports leagues’ intellectual property rights mean you can’t replicate the card images for a t-shirt business, but the rights are certainly broader than what attaches to these NFTs.

A new form of property brings new forms of piracy

Tonya Evans, an intellectual property scholar at Penn State Dickinson Law, studies blockchains and NFTs and wrote an influential 2018 paper on the CryptoKitties phenomenon. She believes that NFTs offer an important new way for creators to connect and earn money from their fans.

She notes that a number of Black artists have been at the forefront of the NFT craze, using forums like the new social media audio app Clubhouse to market and sell their works. Evans says that the tech underlying NFT provides a way to counteract the Internet’s capacity for endless replication and lets artists prove a digital work is unique.

“You can code for the integrity of the work,” said Evans. “Technology threatened the music industry, letting anyone make a perfect digital copy of the original, and now maybe this is the technology that can cure that.”

Evans is right that NFT tech offers new opportunities for creators. It’s not just prominent artists like Grimes or Beeple that are making real money selling NFTs. So are lesser-known artists, who are using platforms like Nifty Gateway and OpenSea to sell limited edition prints of sneakers and boomboxes. In this sense, NFTs represent a new spigot of money that didn’t exist before.

But like everything else on the Internet that makes money, the NFT craze has attracted parasitic bad actors looking to cash in on the works of others. That’s what happened to an artist who creates digital pictures under the name Weird Undead. She discovered someone has been stealing her images and selling them as NFTs:

In the last week, Weird Undead (who asked Decrypt not to use her real name) has been filing a flurry of legal notices with OpenSea—one of the biggest NFT markets—while her fans have been doing the same so as to stop what she calls “insane and pointless copyright infringement.” She has also discovered that copycats have been using a service called Tokenized Tweets to create and sell tweets based on her work, and asked it to stop.

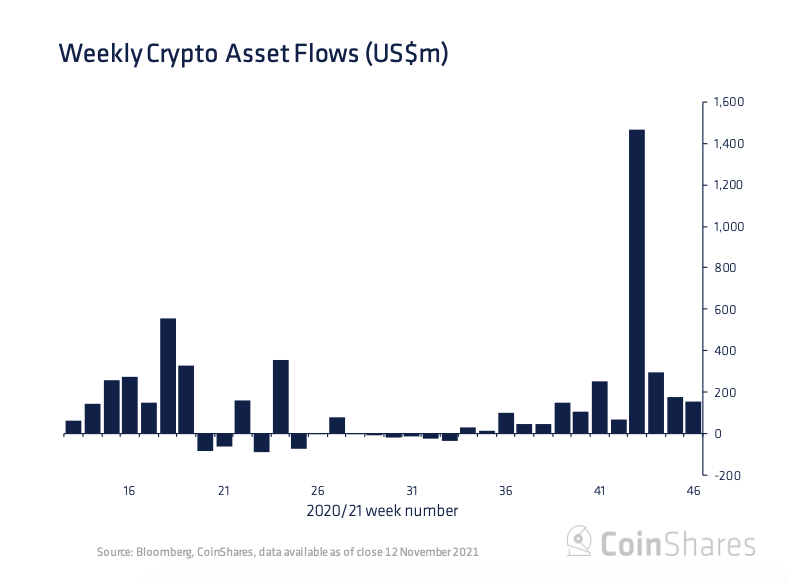

Meanwhile, influential figures in the cryptocurrency industry, including Meltem Demirors of CoinShares and Neeraj Agrawal of Coin Center, have complained of random people repackaging their tweets as tokens for sale:

Hucksters flogging unauthorized tokens are just one part of the emerging piracy problems surrounding NFTs. A potentially more serious one is the emergence of competing blockchain services, each of which promise that they provide the authoritative record that a given NFT is unique. The situation is akin to a town having two competing services to register land deeds, or two auction houses each claiming they have the legitimate title to a piece of fine art. The issue is potentially an existential one for the nascent NFT industry, which stakes its existence on being able to prove a given token is unique.

So far, the main NFT marketplaces are cooperating, with each agreeing to recognize a token as unique even when it passes from one forum to another. But that hasn’t stopped the users of Binance’s blockchain from hosting rogue token shops on the network, which not only sold plagiarized works but also clearly mimicked the store names of existing Ethereum-based NFT shops—for instance “Binance Punks” for “Crypto Punks” and “Bashmasks” for “Hashmasks.”

While trademark and copyright law provides a remedy for rip-offs, it’s likely to prove difficult for artists to find and sue an infringer, since blockchains, by their nature, are designed to be borderless and decentralized. This would explain why some upset by recent behavior on Binance’s network resorted to non-legal measures to express their displeasure—including posting images from the Tiananmen Square massacre on the company’s blockchain. (Binance has ties to China).

Such disputes raise the question of whether NFTs represent just the latest headache for creators trying to make a living from their work. But while NFTs can pose a nuisance, some are optimistic these problems are outweighed by the potential for artists to earn a new form of income—and that NFTs could reshape how we view copyright and the Internet.

A breakthrough in the copyright debate?

Even since consumers began using it en masse in the mid-1990s, the Internet has proved a mixed blessing for artists, writers, and other creators. On one hand, the web provides an enormous new platform to reach fans and find new audiences. On the other, it’s awash with pirates who copy an artist’s work and sell it or give it away for nothing. Meanwhile, the giant tech platforms like Amazon and Spotify have come to enjoy virtual monopolies when it comes to selling digital works and, in the view of critics, failed to pay out a fair share to artists.

All of this has led to two decades of debate about copyright policy. The debate is often bitter with the entertainment industry accusing tech enthusiasts of supporting piracy and robbing artists—while opponents accuse the industry of lobbying Congress to pass copyright laws that they view as draconian and prone to abuse.

The rise of NFTs could help transcend this debate, according to Aaron Wright, a blockchain expert at Cardozo Law School.

“I think the Internet has long offered massive distribution for media, but there has been no monetization scheme that works really well,” he said, adding that NFTs help fix this shortcoming.

Specifically, Wright points out that NFTs finally offer a way for artists to sell digital versions of their work that are scarce and unique. That scarcity means they can not only enjoy a new revenue stream, but also take a cut when the NFT is resold—an arrangement that platforms like the Winklevoss-owned Nifty Gateway help facilitate.

From a broader perspective, Wright says artists’ ability to sell NFTs could take some of the rancor out of the copyright debate as the business model of online distribution shifts from trying to sell as many copies as possible to selling fewer items for more money to dedicated fans.

Wright is not the only one who sees a shift in how creators are trying to make money from the Internet. In recent weeks, venture capitalists and tech watchers have been sharing an influential essay called “1000 true fans” in which Wired editor Kevin Kelly predicted that the future of creative industries would revolve artists selling their work to small communities of passionate supporters. The essay is from a decade ago but, with the arrival of NFTs, Kelly’s prediction appears to be coming true.

In a related trend, tech writer Will Oremus claims that a growing number of Internet users have grown exhausted with mega-platforms like Facebook that rely on algorithms to show a steady stream of emotional or sensational content. He says they are turning instead to smaller forums like SubStack or Clubhouse where “Super Fans” can connect in a more intimate community. If Oremus is correct, the growth of these communities will offer creators new opportunities to make money from the Internet—including from NFTs.

Of course, such rosy scenarios will depend on NFTs proving they are more than a fad. And many people are skeptical that’s the case. Those skeptics include Litecoin creator Charlie Lee, a prominent cryptocurrency entrepreneur, who poured cold water on NFTs last week:

Lee’s tweet underscores how the future success of NFTs depends on persuading a critical mass of people that they are worth owning, and that they will keep their value in the future. Doubters may point to the Beanie Babies phenomenon of the 1990s when people paid hundreds or thousands of dollars for $10 stuffed collectibles, only to see the market collapse and never recover.

On the other hand, each day in 2021 has brought new evidence that people think NFTs are valuable, and will pay good money to own one.

The latest example? This week, a bidder at Christie’s auction house paid $69.3 million to own an NFT artwork by Beeple. It was the third biggest sale by a living artist to date.