Ethereum is leading the charge on this fresh run towards new frontiers. As of press time, the second crypto by market cap trades at $4,432 with a 5.6% profit in the daily and 9.1% profits in the weekly chart.

Up 500% Year To Date, Ethereum has rallied on the back of massive adoption of non-fungible tokens (NFTs), decentralized finances (DeFi), and institutional demand.

As seen below, in the chart shared by Joe Orsini research director at Eaglebrook Advisors, Ethereum has gone from under $1,000 to its current levels in record time.

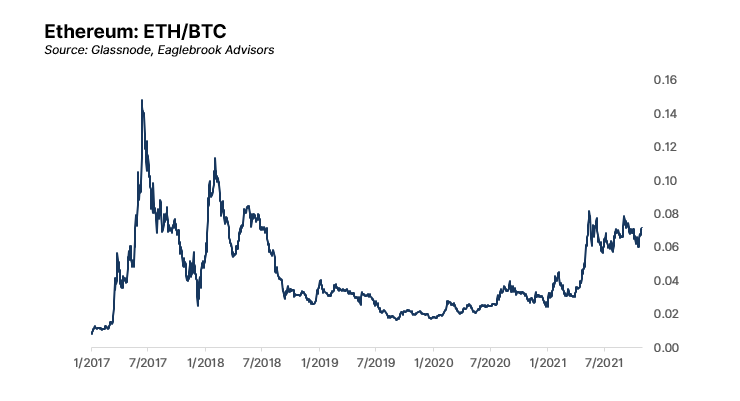

Additional data provided by Orsini indicates that Ethereum still has a lot of room to continue its room has displayed in the ETH/BTC trading pair. Compared to the 2017 bull run, ETH is far from reaching an all-time high of 0.14 BTC as it currently sits at around 0.08 BTC.

In support of the bulls’ current push, Delphi Digital records a “leverage wipeout in crypto futures” as yesterday’s session wash charge with volatility to the downside. Thus, Ethereum and other major coins dipped to previous higher lows in less than an hour.

The fast recovery signals convection on the bulls’ corner. As over-leverage traders were shaken out of their position, prices are more likely to sustain their levels. Delphi Digital claimed:

The average daily funding rate across exchanges is down from its recent high a few days ago, but it looks like there’s still some room for rates to fall. OI on exchanges like Binance and Huobi experienced a massive wipeout, which confirms the aforementioned deleveraging.

Ethereum Implements Hard Fork, Closer To The Merge

The rally in the price of Ethereum could have been driven by the implementation of Hard Fork Altair. The successful deployment of this upgrade puts the network closer to migrating to a Proof-of-Stake consensus.

In the past months, the amount of ETH locked in the ETH 2.0 deposit contract has soared as developers moved into the PoS based blockchain and the Merger. This event will join both networks and it’s expected to be a potential bullish catalyst for Ethereum’s price.

Investors are drawn to the PoS model because of its alleged higher efficiency in energy consumption and its capacity to generate yield. According to the Eth2 Rewards monitor, this stand at 5.46% since October 27, 2021.