- Over 400,000 ETH was pulled out of Coinbase, dropping exchange reserves and driving a supply crisis.

- Average Ethereum gas fees stay above $20 due to an increase in pressure from smart contracts on the network’s blockchain.

- Analysts who are bullish on Ethereum expect ETH price to cross $5000 in an upward climb.

Institutional investors are bullish on Ethereum with rising capital inflow. Ethereum reserves across exchanges have dropped as outflow increases.

Coinbase notes massive Ethereum exchange outflow

Coinbase noted a withdrawal of 400,000 Ethereum tokens, and according to community-driven crypto platform CryptoQuant, it is likely that the outflow was institutional activity. Analysts expect a bullish impact on ETH prices.

400,000 Ethereum tokens are the equivalent of $1.5 billion, withdrawn from the second-largest cryptocurrency exchange. The exchange outflow indicator is considered a sign of increased outflow and a supply shortage in Ethereum.

Ethereum Exchange Outflow.

Ethereum has posted over nearly 20% gains in the past two weeks.

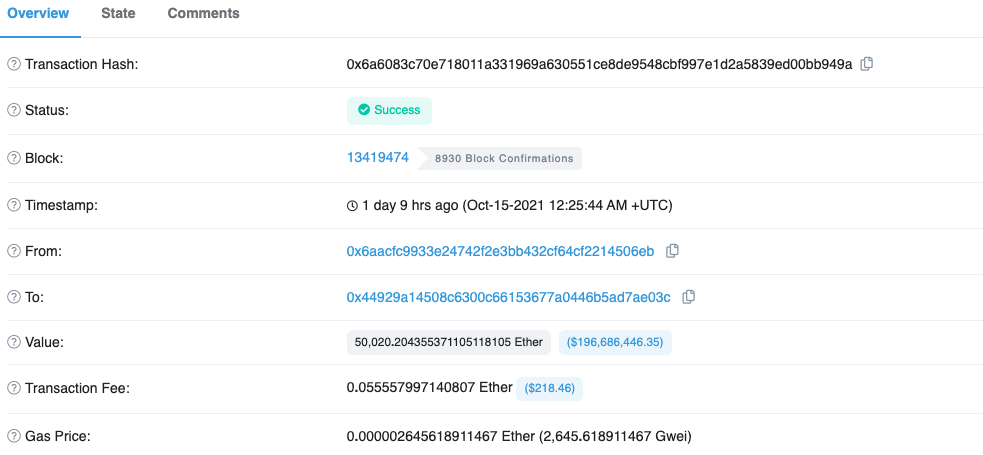

Interestingly, there is a spike in whale activity on the Ethereum network. Over $188 million worth of Ethereum was moved between two anonymous cryptocurrency wallets in a single transaction.

A mysterious whale initiated the transaction, and it was sent to an unknown recipient. The details of the transaction are as follows:

Whale activity on the Ethereum Network.

With news of Bitcoin ETF getting approval by the Securities & Exchange Commission next week, experts are awaiting Ethereum’s turn. Analysts are of the opinion that following Bitcoin ETF approval, capital inflow to Ethereum and altcoins will increase.

Pseudonymous cryptocurreny trader and analyst @jroberts3334 has set a target of $8000 for Ethereum for February 2022.

Simon Dedick, Managing Partner of Moonrock Capital, is bullish on Ethereum; he tweeted:

FXStreet analysts have evaluated the ETH price trend to analyze where altcoin is headed next. Analysts have set a target of $5200 for ETH price.